How would I apply Schedule A Property Tax to Indiana Schedule 2 of Form IT-40 or Schedule C of Form IT-40PNR?

If property tax from federal Schedule A (Itemized Deductions), line 5b (line 6 in Drake17 and prior), is not being applied to Schedule 2, line 2, of the Indiana IT-40 return, or Schedule C, line 2 of the IT-40PNR please read the following information.

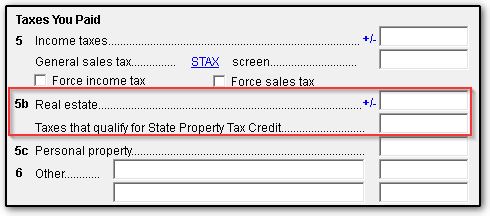

To apply the property tax from Schedule A, line 5b (line 6 in Drake17 and prior), to Indiana Schedule 2 or Schedule C, line 2, you must enter property tax information into two fields on Federal screen A:

Real Estate--Enter the property taxes to be deducted on Schedule A of the federal return.

Taxes that qualify for State Property Tax Credit--Enter the appropriate amount to be applied to Indiana Schedule 2 or Schedule C, line 2.

You can also use the SCH2 screen (Amount of property tax paid field) in the Indiana program to enter the amount that qualifies for the Schedule 2 or Schedule C deduction.

Notes:

- If a state property tax amount is entered on both the Federal A and the Indiana SCH2 screens, the SCH2 amount will override the screen A amount.

- For part-year and nonresident returns, the Federal A screen must have the state code set to IN for the amount to flow automatically to Schedule 2 or Schedule C.

- The residential property tax deduction (Line 2) should not be claimed if the taxpayer is claiming the Lake County residential income tax credit. Select this by going to IN > screen 2 > line 6. From the help for this line:

- If you reside in Lake County and must pay property tax to Lake County on your residence, then you may be eligible for a tax credit. To qualify, you must have paid property tax to Lake County during 20YY and your earned income (combined if filing joint) must be < $18,600 and you must not be claiming the Residential Property Tax Deduction on Indiana Schedule 2/C. The credit cannot exceed $300.

- If Yes is selected, the real estate tax amount on the federal Schedule A, line 6 will be used to calculate the credit. You may override the amounts used for property tax and earned income on Indiana screen LAKE.