Married taxpayers filed separate Federal returns that were accepted. Now, they want to file one amended return together. How is this done?

Amending from MFS to MFJ

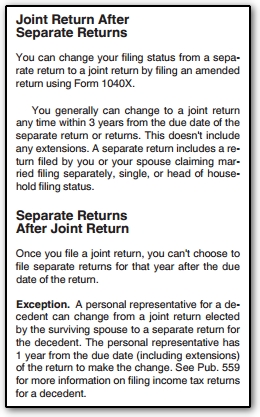

The basic process for filing an amended joint return to replace two separate returns is described in the Form 1040-X Instructions:

"If you and your spouse are changing from separate returns to a joint return, follow these steps.

- Enter in column A the amounts from your return as originally filed or as previously adjusted (either by you or the IRS).

- To determine the amounts to enter in column B, combine the amounts from your spouse’s return as originally filed (or as previously adjusted) with any other changes you or your spouse are making. If your spouse didn't file an original return, include your spouse’s income, deductions, credits, other taxes, etc., in the amounts you enter in column B.

- Read the instructions for column C to figure the amounts to enter in that column.

- Both of you must sign and date Form 1040X."

Amending from MFJ to MFS

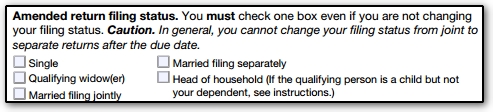

Generally, a MFJ Return Cannot be Changed to MFS After the Return's Due Date. An amended return filed after the due date of the original return cannot be used to change filing status from married filing jointly to married filing separately. This fact is noted on the 1040-X form itself:

See also Publication 501: