How do I correct a business return reject that involves a problem with a business entity’s MN state tax ID?

You are probably seeing one of these rejects:

|

53

|

Partner

S-Corp

Corp

|

StateEIN

|

A 7 digit MN tax ID is required.

|

7-digit numeric StateEIN [016] is required.

|

|

266

|

Partner

S-Corp

Corp

|

StateEIN

|

MN Tax ID is required and must match Department of Revenue Records.

|

StateEIN [016] is required and must match MN ID in Profile System.

|

|

626

|

S-Corp

Corp

|

MinnesotaTaxID

|

If Subsidiary MN Tax ID present then value must match Department of Revenue records.

|

If value present, MinnesotaTaxID [133] must match MN ID in Profile System.

|

|

637

|

S-Corp

Corp

|

MinnesotaTaxID

|

The Subsidiary MN Tax ID submitted must match MN Department of Revenue records and be active.

|

If value present, then MinnesotaTaxID [133] must be valid active MN ID per Profile System

|

|

683

|

Partner

S-Corp

Corp

|

StateEIN

|

Minnesota Tax ID must be registered under the correct Federal EmployerIdentification Number (FEIN).

|

StateEIN [016] must belong to the correct EIN [017] and must match Department of Revenue Records. If you believe you have the StateEIN and EIN. To correct, please call Business Registration (651) 282-5225.

|

|

684

|

Partner

S-Corp

Corp

|

StateEIN

|

Minnesota Tax ID must be registered under the correct tax type. To change or correct your tax type please call (651) 282-5225.

|

StateEIN [016] must belong to the correct ReturnType [089] and match Department of Revenue Records. To change or correct your tax type please call Business Registration (651) 282-5225.

|

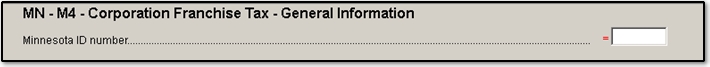

Each business entity filing a Minnesota tax return must register and obtained a unique MN Tax ID prior to filing a MN tax return. Registration is an annual requirement and the registration must accurately describe the entity. To correct one of these rejects, first confirm that the entity has a Tax ID and that it is correctly entered at the top of the MN General Information screen.

- If the entity does not have a Tax ID, it must register to obtain one. To register

- Go to https://www.mndor.state.mn.us/tp/eservices/_/ and select Begin the Registration Process.

- Or call (651) 282-5225 ext 3 (new registration)

- If the entity has a Tax ID number that is correctly entered, it must correct its previous registration for the facts referenced in the reject. To correct a previous registration, call MN Business Registration at (651) 282-5225.