How do I get the lower tax rate for entities primarily engaged in retail or wholesale trade?

The lower tax rate applies only to the Texas long form (Form 05-158). In order to qualify for it, you must enter a qualifying SIC code and correctly answer the three tax rate questions below.

- A qualifying SIC code must be entered in the SIC code field.

- In a 1040 return, on the Gen Info tab of screen 1 Reporting Entity.

- In a business return, on screen 1 General Information.

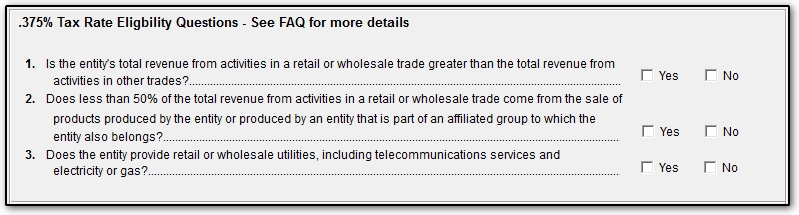

- Check any of the three Tax Rate Questions that apply to the reporting entity.

- In a 1040 return, on the Report Info tab of screen 1 Reporting Entity.

- In a business return, on screen 1 General Information.

Based on the answers to these three questions and the SIC code entered, the software will apply the lower rate automatically if the organization qualifies. If the answers or SIC code disqualify the organization from having the lower rate, the software will default to the appropriate tax rate for that year. For more information on the tax rates of that year's report, or for a list of business activities (and their corresponding SIC codes) that qualify for the lower tax rate, see the instructions.