If a married filing joint return is split, does the software recognize community property rules when the taxpayers are in a community property state?

No. The software does not consider state community property allocation rules when a return is split.

- If you split a return, and find that it is not correct for the state, you must adjust the allocation manually in each individual split return.

- Do not use screen 8958 before the return has been split. Screen 8958 has no effect on property allocation.

- Once the return has been split, use screen 8958 in the split returns to produce Form 8958 to explain how income was allocated.

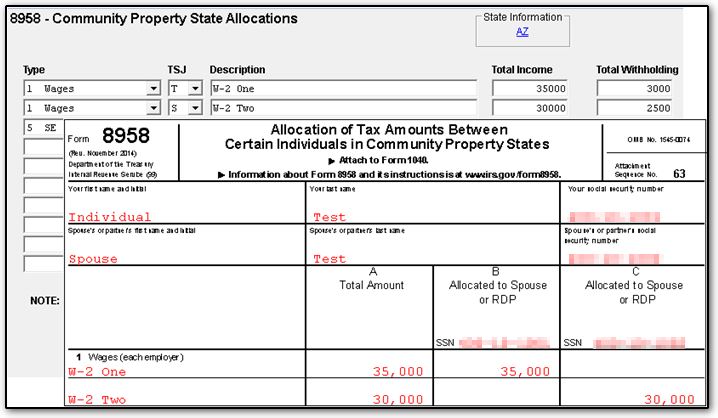

Before splitting a joint return, you will adjust the return so that it will properly send income to the appropriate split return, and then split the return. For community property states, after you split the return, enter a screen 8958 that shows the final allocation. Make any needed adjustments to reflect that allocation. In each split return, this will force the software to produce Form 8958, Allocation of Tax Amounts Between Certain Individuals in Community Property States. The allocation shown on Forms 8958 in the two returns should be consistent.

Prepare to Split the Return

There are two categories of income that you will allocate, separate income (belonging only to the primary taxpayer or only to the spouse) and community income (belonging to both). In a joint return, before splitting it, select T, S or J in the TSJ field, at the top of data entry screens where it is present, to determine how the screen income is directed when you make the split. Use T to indicate separate income to go to the primary taxpayer, S to indicate separate income to go to the spouse and J (when that selection is available) for community income to be split evenly between the two.

Split the Joint Return

On the main data entry screen of the joint return, click the Split icon on the top toolbar. Follow the prompts (for details, see "Creating, Saving and Deleting Split Returns" in Related Links below).

Complete Income Allocation

Open screen 8958 in each split return and indicate how the income is allocated. This produces Form 8958. Make any adjustments in the split returns necessary to reflect that allocation.

Regarding Form 8958:

- Do not prepare it in a joint return before you split the return. A joint return will never produce Form 8958. If you enter screen 8958 in a joint return, then split the return, Form 8958 will not be split between the taxpayer and spouse, and will only appear in the primary taxpayer’s split return.

- Income entered on screen 8958 does not change data entered in the Federal return. Form 8958 only explains how you allocated income. If the split returns need to be changed to allocate income correctly, you must make those changes manually.

- Screen 8958 refers to T (the taxpayer in the split return) and S (the taxpayer in the other split return). In view, Form 8958 refers to both taxpayers as "Spouse, RDP or California Same-Sex Spouse", identifying each by SSN.

If Form 8958 is needed, a Federal Note is produced, and a state EF message may also be produced.

Form 8958 is transmitted with the split returns.

States considered Community Property States:

Community property states are Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington, and Wisconsin. If you and your spouse lived in a community property state, you must usually follow state law to determine what is community income and what is separate income. For details, see Form 8958 and Pub. 555.

Nevada, Washington, and California domestic partners. A registered domestic partner in Nevada, Washington, or California generally must report half the combined community income of the individual and his or her domestic partner. See Form 8958 and Pub. 555.

For more information, see Form 1040 Instructions

See Pub. 555 for more information about community property returns.