A California return is producing EF Message 1011 saying the social security number (SSN) or employer identification number (EIN) needs to be within a valid range of SSNs or EINs. What does this mean?

If you see this message, review your data entry. On CA screen 3506, the SSN or EIN of the care provider should be entered. It must match the one entered on federal screen 2441.

- If you are using an employer identification number for a business, check the EIN box on federal screen 2441.

- If you are using a social security number make sure the EIN box is not checked on federal screen 2441. Also, a last name for the provider must be entered.

If the SSN/EIN number is not available, the CA return will have to be paper-filed.

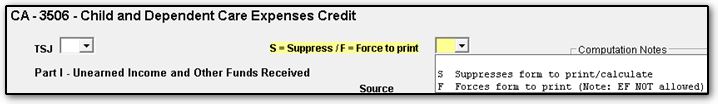

Additionally, if the taxpayer is not eligible for the credit, suppress the form on the 3506 screen. Select code S from the Suppress drop list at the top of the screen.