Where do I enter non-taxable Original Issue Discount (OID) Interest in a 1040 or 1041 return?

Interest from a 1099-OID can be entered on the OID screen under the Income tab in the 1040 or 1041 returns. The OID screen is not available in other packages.

In prior years, interest income from Form 1099-OID could be entered either on:

- Screen 3 (if less than $1,500).

- or Screen INT (if $1,500 or more)

Note: The 1099-OID may still be entered in these locations, but be careful that you do not enter the information in both places.

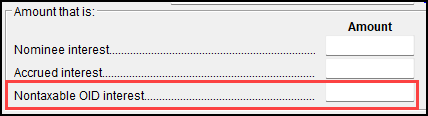

When entering the OID on the INT or OID screens, in the event that some of the interest is non-taxable, enter total interest on line 1 and the non-taxable OID interest in the Amount that is section at the bottom-left corner of the screen in the Non-taxable OID interest field.

The non-taxable amount shows on the Schedule B in the View/Print mode mode as “OID ADJUSTMENT.”

For more information see the instructions for Form 1099-OID.