Where do I enter payments described in Notice 2014-7?

In some cases certain payments made to taxpayers through the foster care system or by Medicaid CNA are reported on a W2 or 1099-MISC, but may be excluded under this notice and removed from the return. If the taxpayer received payment as described in Notice 2014-7, report the payments in Drake Tax as follows.

Taxpayer Received Form W-2

- Open the W2 screen.

- Enter information as presented on the W2 received by the taxpayer.

- Open screen 3 (Income).

- Enter the amount to exclude under Notice 2014-7 in the applicable line:

- In Drake22 and Drake23, line 8s.

- In Drake21, line 8z.

- In Drake20 and prior, line 8 and the row titled "W-2 income excluded per Notice 2014-7."

Taxpayer Received Medicaid Waiver Payments that were Not Reported on Form W-2, 1099-MISC, or 1099-NEC

- Open screen 3 (Income).

- Enter the amount on the applicable line:

- In Drake22 and Drake 23, line 1d.

- In Drake21 and prior, line 1 Other income reported on line 1 (NOT W-2 wages).

- Enter the amount to exclude under Notice 2014-7 in the applicable line:

- In Drake22 and Drake23, line 8s.

- In Drake21, line 8z.

- In Drake20 and prior, line 8 and the row titled "W-2 income excluded per Notice 2014-7."

Taxpayer Received Form 1099-MISC, Box 3 Amount (Drake22 and Drake23)

- Open the 99M screen.

- Enter information as presented on the 1099-MISC received by the taxpayer.

- In the For drop list, choose 1d - Form 1040, line 1d if Other income.

- Open screen 3 (Income).

- Enter the amount to exclude under Notice 2014-7 on line 8s.

Taxpayer Received Form 1099-MISC, Box 3 Amount (Drake21 and prior)

- Open the 99M screen.

- Enter information as presented on the 1099-MISC received by the taxpayer.

- Open screen 3 (Income).

- Enter the amount to exclude under Notice 2014-7 in the applicable line:

- In Drake21, line 8z.

- In Drake20 and prior, line 8 and the row titled W-2 income excluded per Notice 2014-7.

Taxpayer Received Form 1099-NEC (previously 1099-MISC, Box 7)

- Open the 99N screen.

- Enter information as presented on the 1099-NEC received by the taxpayer.

- In the For drop list, choose C.

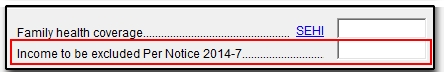

- Open screen C (Self-Employed Income).

- Enter the amount to exclude under Notice 2014-7 in the field titled Income to be excluded per Notice 2014-7, located below Part II, Expenses, on the C screen.

Notice 2014-7 Income and EIC

Starting in Drake19, Notice 2014-7 income is included in the EIC calculation by default. If you wish to exclude Notice 2014-7 income from earned income and have it omitted for Earned Income Credit purposes, use the following data entry:

- In Drake22 and Drake23, use the drop list available on the EIC screen. Three options are available:

- T - Exclude Taxpayer's Medicare Waiver Payments only

- S - Exclude Spouse's Medicare Waiver Payments only

- X - Exclude both Taxpayer's and Spouse's Medicare Waiver Payments

- In Drake21 and prior, check the box Exclude Medicare waiver payments from the earned income credit calculations on the EIC screen.

- In Drake20 and Drake19, check the box Exclude Medicare waiver payments from the earned income credit calculations on the 8812 screen.

In Drake18, the Notice 2014-7 income was not included in EIC calculations by default. To include those amounts in EIC calculations, use the check box on the 8812 screen under Notice 2014-7 Income.

For more information on Notice 2014-7 visit the IRS Notice 2014-7 website.