How do I deduct 25% of the Connecticut pension for a retired teacher?

Beginning in tax year 2015, retired Connecticut teachers can deduct a percentage of the federally taxable Connecticut source teacher's pension on the CT1040 or the CT1040NR. In 2015, the percent was 10%, however, starting in 2016, the deduction amount was raised to 25%.

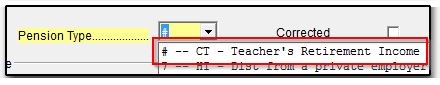

To deduct the federally taxable pension, go to the federal 1099 screen and choose # -- CT - Teacher’s Retirement Income from the Pension Type drop menu:

Choosing this option will calculate the deduction of the federally taxable CT source pension, and apply the amount on the CT1040, page 3, line 45 or the CT1040NR, page 3, line 47.

You can use the field available on CT screen 2 Modifications to FAGI, Res line 45 or NR/PY line 47 to override the Connecticut teacher’s retirement income deduction, if needed.

See the CT 1040 Instructions for details.