How can I mark the 1120 as a Small Corporation that is Exempt from AMT?

A corporation is treated as a small corporation exempt from the AMT for its current tax year if:

- The current year is the corporation's first tax year in existence (regardless of its gross receipts for the year), or

- Both of the following apply:

- It was treated as a small corporation exempt from the AMT for all prior tax years beginning after 1997, and

- Its average annual gross receipts for the three-tax-year period (or portion thereof during which the corporation was in existence) ending before its current tax year did not exceed $7.5 million ($5 million for the corporation's first 3-tax-year period).

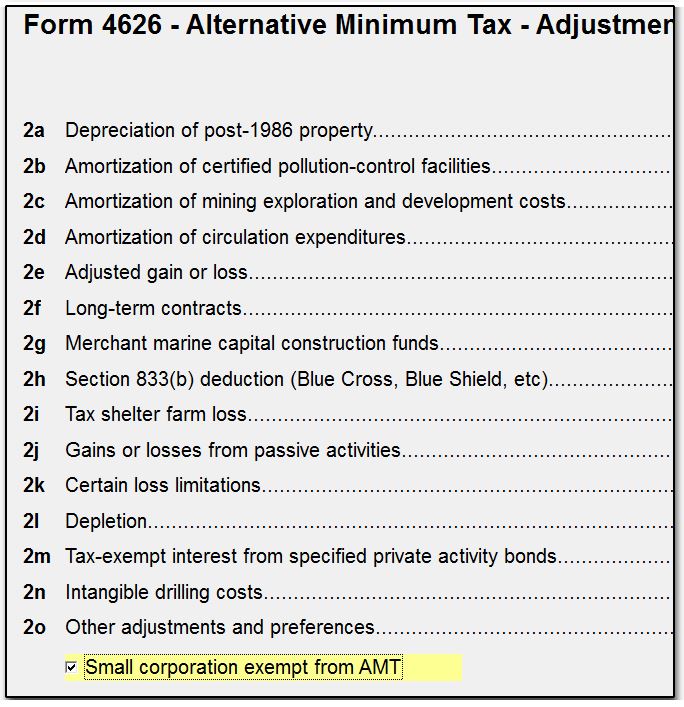

The checkbox to indicate that the 1120 is a small corporation exempt from AMT is located on the 4626 screen, which can be found on the second Other Forms tab in data entry.

For further information regarding exemption for small corporations, see the Form 4626 instructions.