In the 1065 package, where can I indicate that my NY IT-204-LL is for a disregarded entity?

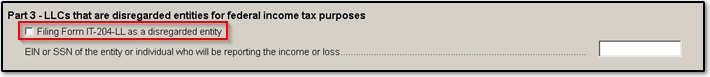

In Drake Tax, you can indicate that a NY IT-204-LL will be filed as a disregarded entity within the NY data entry. Click on the Other tab on the top right of the screen and select the 204L (LLC/LLP Filing Fee Payment Form) screen. In Part 3 of this screen, you will see the indicator declaring that the entity is Filing Form IT-204-LL as a disregarded entity, as well as an entry point for the EIN or SSN of the entity or individual who will be reporting the income or loss.