I have a Schedule C present in view after deleting it in Data Entry. How can I stop this from being created?

If you have a return that continues to create a Schedule C (or Schedule C-EZ*) after it has been deleted in Data Entry, it is being generated as a result of entries that are present on the 1099-MISC and/or 1099-NEC.

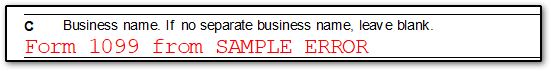

If this issue is occurring, view the return and select the Schedule C. When you select this form, view the Business Information section at the top of the form and review line C Business Name.

On the Schedule C line C Business Name will look similar to the following:

Note: If you have more than one 1099-MISC and/or 1099-NEC, you will need to review each of them to ensure that none are erroneously pointed to the Schedule C.

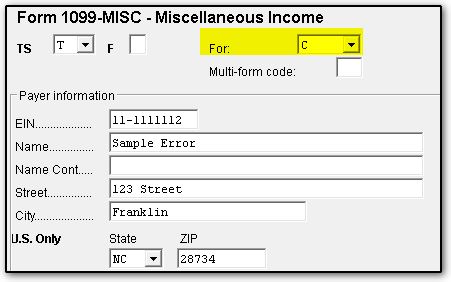

To remove the unnecessary Schedule C, go into Data Entry > General tab > screen 99M 1099-MISC Miscellaneous Income or 99N 1099-NEC Nonemployee Compensation > complete one of the following scenarios:

- Remove or change the entry in the For drop-down at the top of the screen(s).

- Delete the screen(s) by pressing CTRL+D if applicable.

- Complete the screen(s) as applicable.

Note: If you complete Step 1 or 2 above, you will need to delete the Schedule C screen that was created in Data Entry before viewing or calculating the return.

*In Drake18 and prior, a Schedule C-EZ instead of Schedule C may be generated in view if the above applies. Beginning with tax year 2019, Schedule C-EZ has been eliminated by the IRS, and thus Schedule C-EZ will not be generated. No options related to Schedule C-EZ will exist starting in Drake19.