Drake Accounting®: How do I update my chart of accounts from a prior year?

When you first open a client’s Chart of Accounts (COA) in Drake Accounting® 20YY, the software will either update the COA automatically from Drake Accounting® or it will prompt you to set up a new COA. Make sure the COA is set up by entering all beginning account balances before beginning bookkeeping in Drake Accounting® 20YY.

YY refers to the current year, XX refers to the prior year.

Overview to Updating a Client’s COA

There are three situations that can occur when updating a client's COA into Drake Accounting® 20YY:

- If the Drake Accounting® COA has been closed out for the year:

- A full COA update brings forward both the account structure and balances from the prior year.

- Drake Accounting® will automatically do a full Chart of Accounts update when the Client has been brought forward from the previous year.

- If the Drake Accounting® COA is corrupt, but has been closed out:

- If the Drake Accounting® COA cannot be closed out:

- Only the COA account structure can be updated.

- Once the prior year bookkeeping has been closed out in the prior year, go to Accounting > Update Prior Year in Drake Accounting® 20YY to bring forward those balances.

After going to Accounting > Update Prior Year and going through the process, open the client and go to Client > Edit > Business Information tab to verify the Start of Year date is correct.

1. Year End Close has Already Been Done in Drake Accounting® 20XX

If you have done a Year End Close in Drake Accounting® 20XX and are updating the client into Drake Accounting® 20YY, you do not need to go to Accounting > Update Prior Year in Drake Accounting® 20YY because the COA will automatically come over.

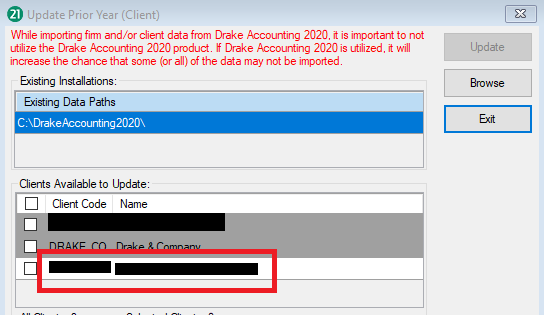

- If you do this and then go to Accounting > Update Prior Year in Drake Accounting® 20YY, the clients that are available to be updated will be highlighted in a dark gray, as shown below, which means the COA has already been updated.

- Updating it again will cause the amounts in the COA to be what they were in Drake Accounting® 20XX when doing the Year End Close.

- It will bring over the posted transactions from the 20XX software.

- The COA screen will be overwritten, but the update would not replace any of the transactions.

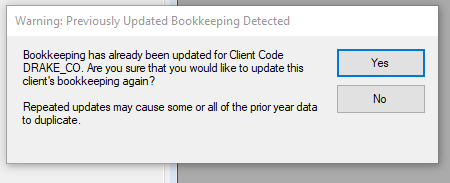

- The following message will appear:

Choose Yes if you are certain that you want to re-update the bookkeeping.

2 or 3. Year End Close has NOT Already Been Done (or cannot be done) in Drake Accounting® 20XX

If you have not done a Year End Close in Drake Accounting® 20XX:

- Update the Client from the 20XX software into Drake Accounting® 20YY (Client > Update Prior Year).

- After you are finished with all the 20XX bookkeeping in the 20XX software, complete a Year End Close by going to Accounting > Year End Close.

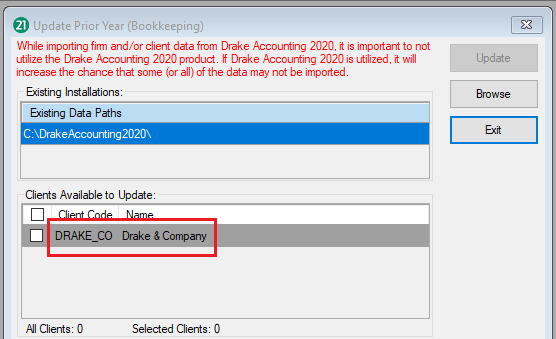

- Once completed, in Drake Accounting® 20YY, go to Accounting > Update Prior Year.

- Select the appropriate data path.

- If the needed data path is not listed, click Browse.

- Select the DrakeAccounting20XX folder.

- Do NOT go into the folder. Selecting something from within the folder will result in a message Installation path is invalid. Unable to find DrakeAccounting20XX.exe in the selected path. Please select a valid installation path.

- Once the correct path is selected, if a client's bookkeeping is able to be updated, it will be listed in white, to indicate that their COA has not been brought over yet.