Drake Accounting®: How can I exclude an employee's commission or piece work from overtime pay?

To exclude an employee's commission or piece work from overtime pay, follow the steps below:

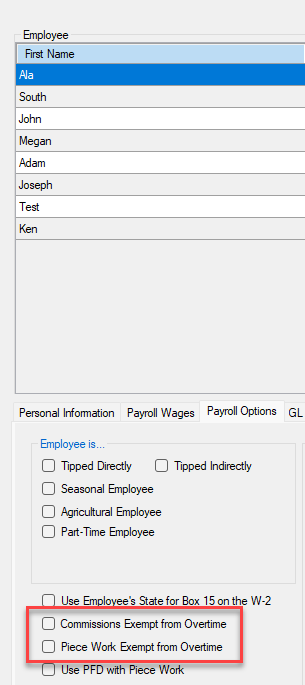

- Go to Employees > Employee Setup, and then select the desired employee.

- Once you have selected the desired employee, click the Payroll Options Tab.

- On this tab select the checkbox in the bottom left corner for Commissions Exempt from Overtime or Piece Work Exempt from Overtime, as applicable.

If a retail or service employer elects to use the Section 7(i) overtime exemption for commissioned employees, the following three conditions must be met:

- The employee must be employed by a retail or service establishment, and

- The employee's regular rate of pay must exceed one and one-half times the applicable minimum wage for every hour worked in a work week in which overtime hours are worked, and

- More than half of the employee's total earnings in a representative period must consist of commissions.

See the US DOL Fair Labor Standards Act, section 207(i) for details on commissioned employees exempt from overtime.

See Section 207(g) for details on employment at piece rates and other guidelines that must be met before checking the option to "exempt from overtime."