Why was my client’s New Mexico PIT-1 rejected with reject code 847? Why am I receiving EF Message 0056 on this NM return?

The New Mexico Department of Taxation and Revenue announced a new business rule 847 for any tax return e-filed with the federal IDS Identification for Taxpayer/Spouse screen having a check in the field “Mark this box if the taxpayer did not provide a driver’s license or state-issued photo ID.”

A recent mailing from the Department of Taxation and Revenue stated the following:

"To process a New Mexico Personal Income Tax Return, it must contain state issued identification numbers or the word “NONE” if you do not have a state issued driver’s license or identification card. The State of New Mexico requires:

- The Primary Taxpayer Driver’s License Number, State Identification Number or the word “NONE” if the primary taxpayer does not possess either a Driver’s License Number or a State Identification Number, or

- The secondary Taxpayer’s Driver’s License Number, State Identification Number or the word “NONE” if the secondary taxpayer does not possess either a Driver’s License or a State Identification Number, or

- Both."

Drake Software has added red message 0056 in response to New Mexico’s new requirement:

The box "Did not provide a driver's license or state-issued photo ID" has been marked for either the taxpayer or the spouse on the Federal IDS screen. If this information is not provided then the return will need to be paper filed to New Mexico.

New Mexico Business Rule 847 prohibits e-file if the "Did not provide a driver's license or state-issued photo ID" box is checked on the Federal IDS screen.

To e-file the NM return, you have two choices:

- Enter a valid Driver's license or state-issued photo ID* for the taxpayer/spouse, or

- Check the box "Mark this box if the taxpayer/spouse doesn't have a driver’s license or state-issued photo ID" (if applicable).

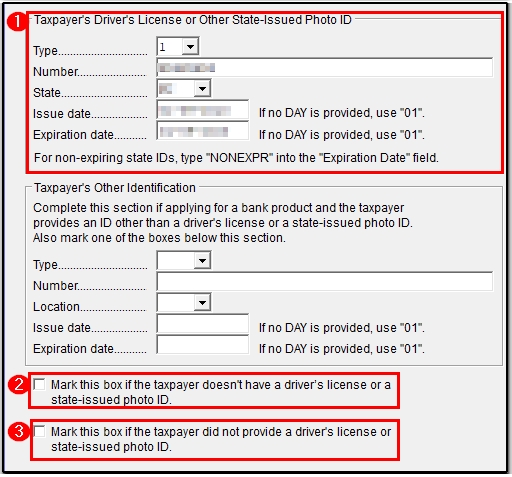

New Mexico Business Rule 847 prohibits e-file if the “Mark this box if the taxpayer/spouse did not provide a driver’s license or state-issued photo ID” (3) is checked in Federal IDS screen:

For any return rejected by New Mexico prior to the addition of NM EF Message 0056, the options are to provide the driver’s license or state ID information, check the box “Mark this box if the taxpayer doesn’t have a driver’s license or a state-issued photo ID" (if applicable), or paper-file the return.

Note that a paper-filed return without the required ID may be delayed in processing.

*If entering a valid Driver's License or State-issued photo ID, on the IDS screen, complete these fields:

- Type. From the Type drop list, select the identification being used for the tax return, either 1 - Driver’s license or 2 - State-issued photo ID.

- Number. Enter the driver’s license number or state-issued photo ID number.

- State. From the State drop list, select the state abbreviation.

- Issue date. Enter the issue date of the driver's license or state-issued photo ID.

- Expiration date. Enter the expiration date of the driver’s license or state-issued photo ID.

- Note: for a State-issued photo ID (selection 2) an expiration date is not required to be entered.

If entering an Arizona Driver's License, the expiration date is considered to be the taxpayer's 65th birthday and should be entered as such. This will cause a red message when filing a NM return if the expiration date is not entered for a driver's license.