How do I clear Kentucky EF Messages 1102 and 1103?

KY EF Message 1102 states:

This return cannot be e-filed because the AGI on the KY740, Line 5 does not match the Federal AGI. Please review the return and check for any discrepancies.

This message occurs on KY resident returns.

KY EF Message 1103 states:

This return cannot be e-filed because the AGI on the KY740NP, Line 8 does not match the Federal AGI. Please review the return and check for any discrepancies. This may have occurred as a result of the program's function of selecting the state martial status with the most favorable tax consequences, i.e only the first KY740NP is compared to the Federal AGI.

In order to file this return there are three options:

1) Paper file the returns as is;

2) Change the state filing status to married and then e-file; or

3) Use the Split function (ctrl+S) to split the return and e-file the state returns.

This message occurs on KY part-year and nonresident returns.

These messages most commonly occur when the federal return is filed as Married Filing Jointly (MFJ) and Kentucky uses a different filing status based on which filing status would be most beneficial for the taxpayer.

There are 3 ways to handle this EF Message when the KY filing status is the cause:

- Paper-file the return.

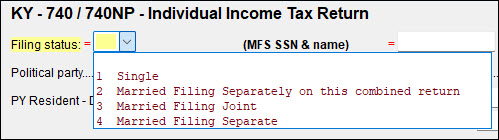

- Go to the States tab > KY > Screen 1 - Individual Income Tax Return > Override the filing status from the drop list.

- Split the return using (Ctrl+S) and file the states separately. See Related Links below for more information on this process.

EF Message 1102 can also be caused when the override fields on KY screen 1 are used to override the AGI from the federal return on a KY resident return.

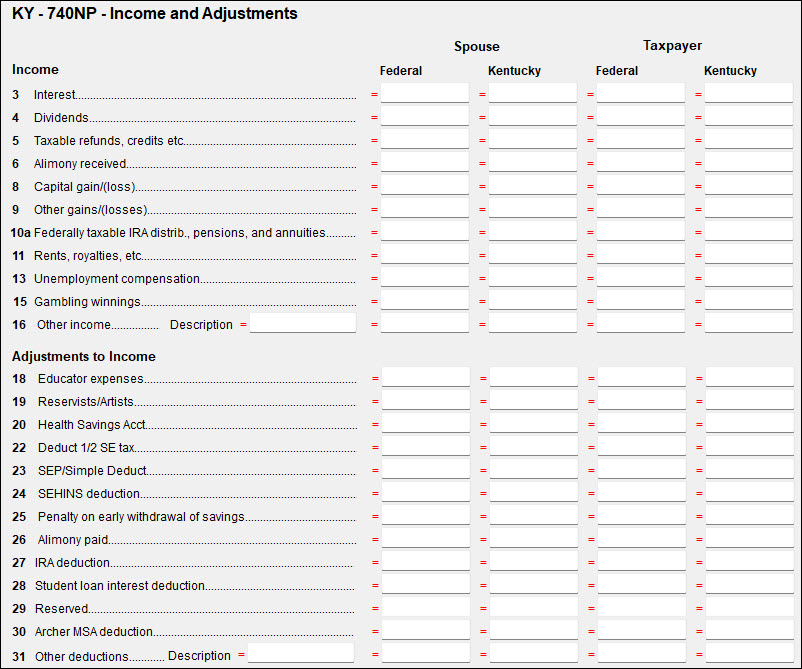

EF Message 1103 can also be caused in a similar way. Using any of the override points on KY screen NP for the taxpayer and/or spouse on a part-year or nonresident return will cause the message to appear.

If an override on these lines is necessary for the return to be correct, the return will have to be paper-filed.