Drake Accounting®: How do I create and file the Indiana Unemployment Insurance Quarterly Tax Report?

For filing to the Indiana Department of Workforce Development (DWD) website, DAS produces:

- A .txt or .csv file that can be uploaded to the DWD website.

- A PDF of the report that can be printed for record-keeping purposes only.

Indiana does not allow software vendors to create a printed report that can be mailed in.

See Related Links below for required setup before creating the state wage report.

To prepare the report:

- Select the Employees or On the Fly menu, then select State Tax & Wage Forms.

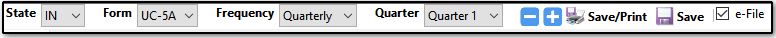

- Make sure IN is selected, then select UC-5A from the Forms drop list.

- Select the applicable quarter.

- Review the form and make any necessary entries or edits.

- Make sure the e-file checkbox is marked, then select Save/Print. This creates the watermarked PDF for record-keeping purposes, as well as the .txt file to upload to Indiana DWD. The option to save as a .csv file is also available.

To upload:

- Log in to the Indiana DWD Employer Self Service website.

- Follow the menu options to upload the file.

- The upload file can be found by browsing to the drive where DAS is installed > DrakeAccounting20YY > DAS20YYData > Clients > client code > EFile > IN > INUC5A (DrakeAccounting20YY > Clients > client code > EFile > IN > INUC5A in DAS20 and prior) and selecting the file named IN_UIWAGE_Qtr#.TXT or IN_UIWAGE_QTR#.CSV (where # is the quarter for which the file was produced).

If you have not registered for an ESS account, see Indiana DWD Employer Self Service FAQ for detailed instructions.

For more information regarding preparing and filing the IN Quarterly Wage Reports, see the Indiana DWD ESS Enhancement FAQ.