Does North Carolina have a credit or deduction similar to the federal Child Tax Credit?

Yes, the NC Child Deduction can be claimed by NC resident and part-year resident filers with eligible dependent(s). Per the NC DOR: "An individual may claim a child tax credit for each dependent child for whom a federal child tax credit was allowed under section 24 of the [Internal Revenue] Code." This deduction is non-refundable and appears on NC D-400, page 2, line 10.

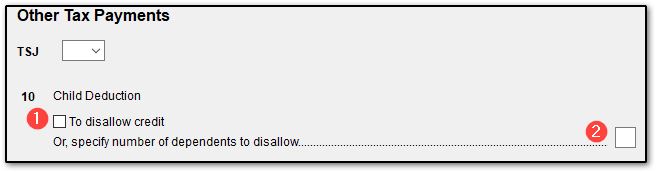

In Drake Tax, any child who is entered on federal screen 2 that meets the requirements for federal CTC will be counted for the purposes of the NC Child Deduction. An override is available on the NC > PMTS screen. Check the box To disallow credit for all dependents on the return. To disallow the deduction for select dependents, enter a value for specify number of dependents to disallow.

The credit is subject to phase-out limits based on the federal AGI and filing status. See the NC DOR for phase-out limits and more information on this deduction. For the federal definition of a qualifying child, see Publication 972.