How do I e-file a return using Drake Zero or Web1040?

To e-file a return using Drake Zero or Web1040:

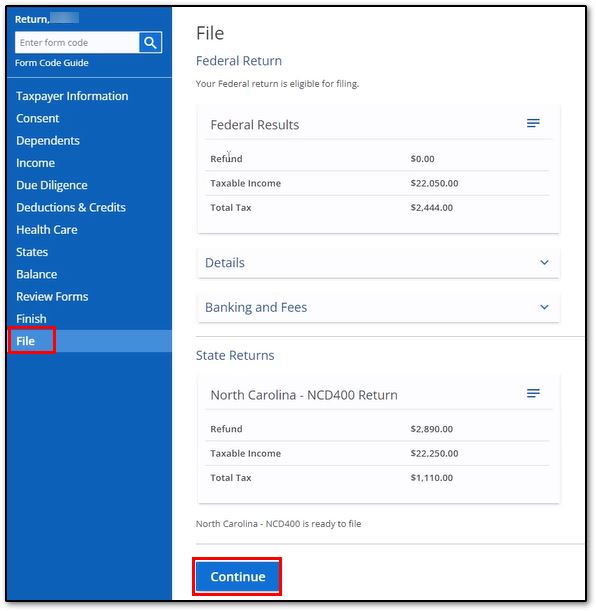

- Click on the File tab.

- Verify the information, and click Continue.

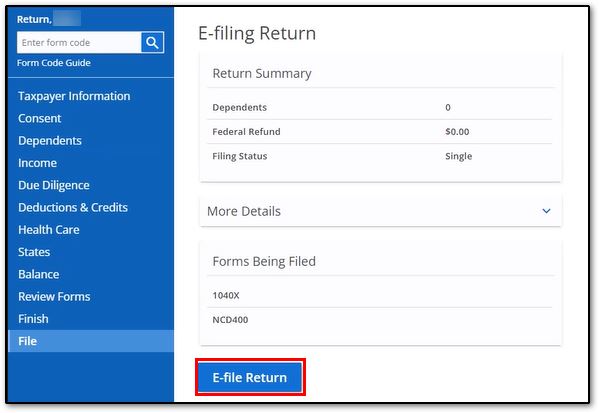

- Review the details for accuracy, then click E-file Return:

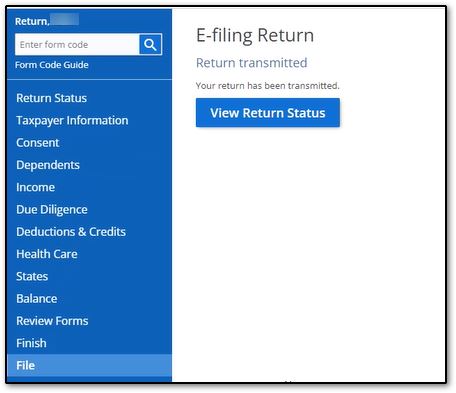

- The return is transmitted:

- To check the status, click on the Return Status tab.

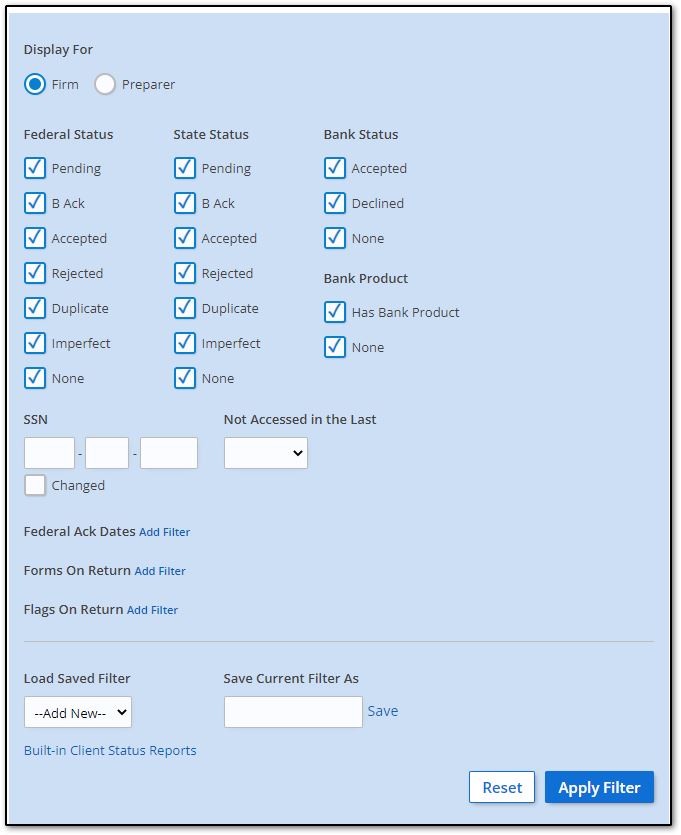

Client Status Report

You can also run a report by exiting the return and clicking on Reports > Client Status. You can run a report for all returns, or enter a SSN to search for detailed information for a single taxpayer.

Note: Filters may vary depending on office setup.

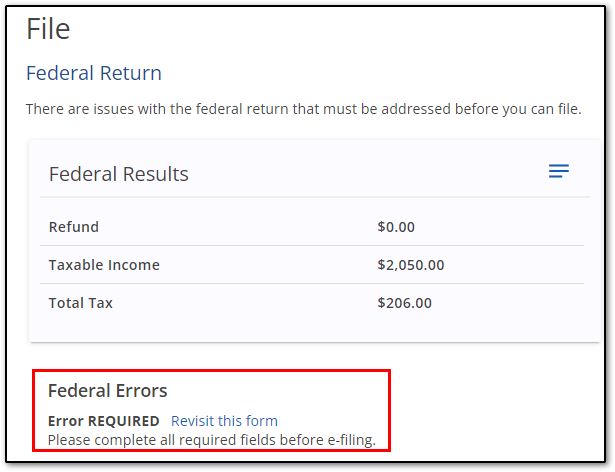

EF Messages

The example above shows a federal and NC state return that are both ready for e-filing with no error messages. If any errors are shown, they must be corrected before e-filing is available. Click the blue link to return to the relevant entry form: