2024.03.14 Broadcast - WEBCAST: Manage Schedule C & Schedule E assets and more - CPE Training

Drake In-Depth: Schedule C and Schedule E

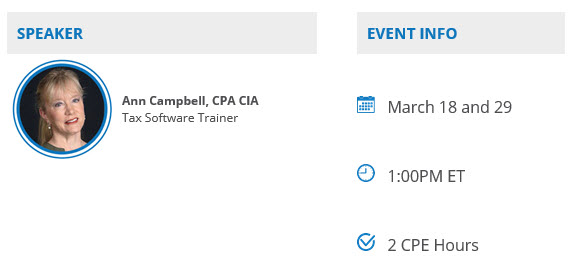

Learn from experienced instructor and software expert Ann Campbell, CPA CIA, as she addresses the complexities of self-employment and rental income. |

Register Now

|

|

Drake In-Depth - Schedule C

- Effectively manage, depreciate, and sell Schedule C assets

- Process automobile expenses and installment sales

- Calculate self-employment tax and prepare estimated payments

- Generate the Qualified Business Income (QBI) deduction

Drake In-Depth - Schedule E

- Effectively manage, depreciate, and sell Schedule E assets

- Handle auto expenses and 1098 mortgage interest

- Capitalize assets and apply the de minimis election

- Process installment and group sales

- Review Form 8582, Passive Activity Loss Limitations

|

|

|

|

|