Drake Accounting®: Why can't I e-file Form 941-X when there are negative amounts in columns 1 and 2?

On September 17, 2024, the IRS identified an error in their 2024 Form 941-X e-file schema that prevents Form 941-X from being e-filed when negative values are present in columns 1 and 2.

The IRS does not currently have a resolution date and provided the following workaround:

- From Employees > Federal Forms or On the Fly > Federal Forms, open Form 941-X.

- Under Selection and Options, select Override Calculated Data.

- Make any amounts in columns 1 and 2 that should be negative positive instead. Make sure that the corresponding amounts in columns 3 and 4 are calculated as though columns 1 and 2 are negative.

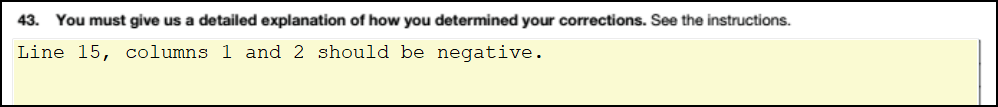

- On line 43, explain what numbers should be negative.

- Transmit Form 941-X.

This article will be updated once the IRS makes the necessary adjustments to the 941-X e-file schema. We apologize for any inconvenience caused.