Tax Reform Likely to Result in Fewer Taxpayers Who Itemize

The tax reform package that went into effect at the end of 2017 effectively doubled the standard deduction for individuals. According to the Internal Revenue Service, that change alone is expected to reduce the number of taxpayers who would otherwise itemize.

Previously, roughly one out of three taxpayers itemized. But the tax reform package – termed the Tax Cuts and Jobs Act – doubles the standard deduction for all filing statuses. So many qualifying taxpayers could find the increased standard deduction amounts to more money than their total itemized deductions, therefore opting for the simpler standard deduction.

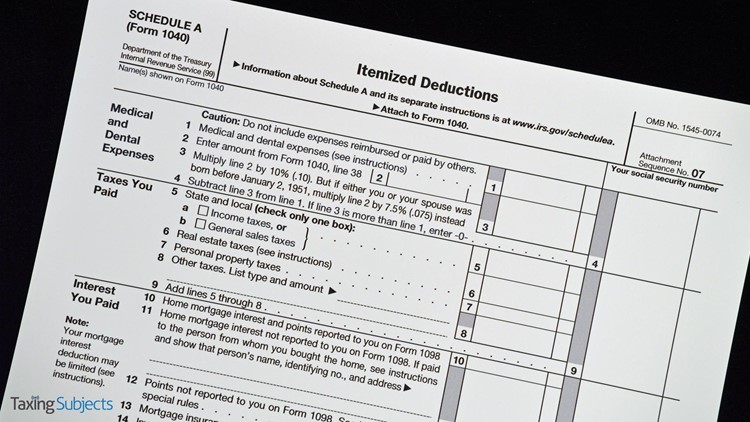

How to know? Taxpayers should check their 2017 itemized deductions to see what the new standard deduction means for them in 2018. Taxpayers who still want to itemize will complete an updated version of Schedule A, Itemized Deductions, along with their return.

Publication 5307, Tax Reform Basics for Individuals and Families, is a key resource to understanding the impact of the tax reform law on deductions. The publication provides information about:

- increasing the standard deduction,

- suspending personal exemptions,

- increasing the child tax credit,

- adding a new credit for other dependents, and

- limiting or discontinuing certain deductions.

The IRS has other reminders to help taxpayers Get Ready for the upcoming tax filing season and has recently updated its Get Ready page with steps to take now for the 2019 tax filing season.