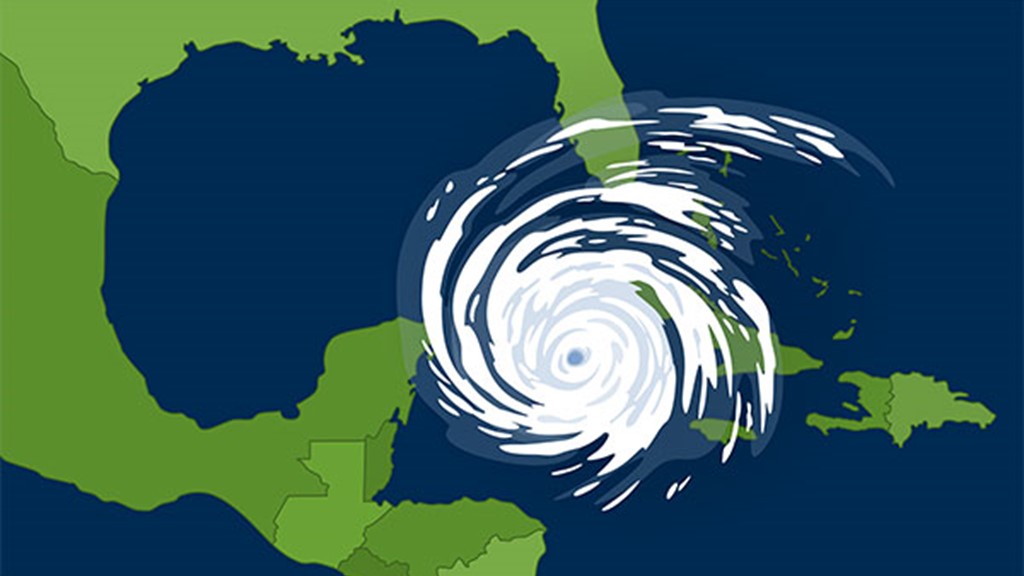

IRS Disaster Relief

The IRS issues relief packages to areas that recently experienced natural disasters or events designated as disasters by the United States government. This blog post provides extension details and provides information on IRS legislature about filing tax returns in the wake of extreme weather or disaster incidents. Bookmark this post for updates!…

![Name, Image, and Likeness (NIL) Income for College Athletes [DOWNLOAD]](/media/3270/nil.png?anchor=center&mode=crop&width=1024&height=576&rnd=133498688980000000)