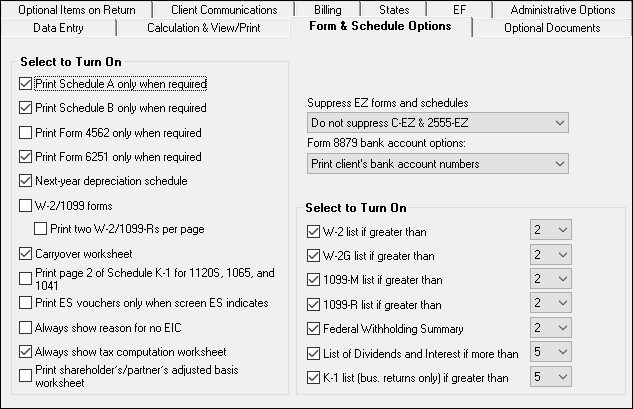

Form & Schedule Options

Option |

Description |

Print Schedule A only when required |

Produce Schedule A only when taxpayer qualifies to itemize. |

Print Schedule B only when required |

Produce Schedule B only when taxpayer has enough interest income to require filing Schedule B. |

Print Form 4562 only when required |

Produce Form 4562, Depreciation and Amortization, only when the tax return requires it. |

Print Form 6251 only when required |

Produce Form 6251, Alternative Minimum Tax, only when the tax return requires it. |

Next year depreciation schedule |

Produce a depreciation schedule for next year in addition to the one for this year. |

W-2/1099 forms |

Produce and display in View mode all W-2 and 1099-R forms with the return. |

Print two W-2/1099-Rs per page |

If return has more than one W-2 or 1099-R form, print two per page. |

Carryover worksheet |

Produce any carryover worksheets associated with the return. |

Print page 2 of Schedule K-1... |

Produce page 2 of Schedule K-1 for Forms 1120S, 1065, and 1041. |

Print ES vouchers... |

Prints ES vouchers only when screen ES exists. |

Always show reason for no EIC |

Generate Return Note explaining reason taxpayer not getting EIC. |

Always show tax computation worksheet |

Generate tax computation worksheet. |

Print shareholder's/partner's adjusted basis worksheet |

Make this selection to automatically print a partner's or shareholder's adjusted basis worksheet. |

1040A/EZ suppress |

Automatically suppress Form 1040A or 1040EZ. |

Suppress EZ forms and schedules |

Choose to automatically suppress Schedule C-EZ, Form 2106-EZ, or Form 2555-EZ. |

Form 8879 bank account options |

Select option for printing bank account information on Form 8879. |

Select to Turn On ___ list if greater than... |

Produce lists of these items (W-2, W-2G, 1099-M, 1099-R, federal withholding summaries, dividends, interest, K-1) when the selected number in the drop list is exceeded. |