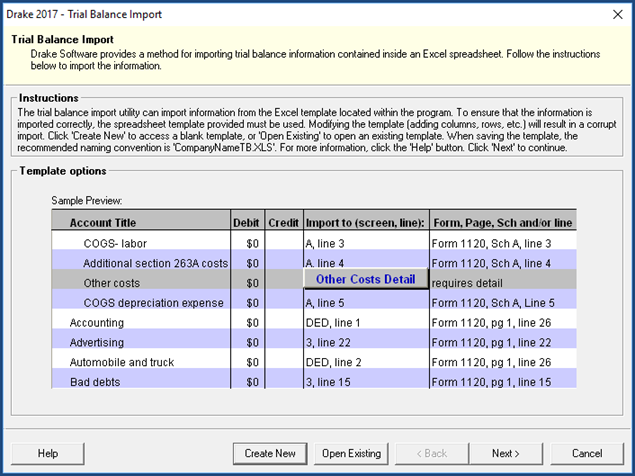

You can import a client's trial balance information from an Excel spreadsheet template located within the Drake Software. To use this feature within a Corporate, Sub-S, or Partnership return, click Import in the Data Entry Menu and select Trial Balance Import.

Creating the File

Whenever a new template is opened, the software assigns it a default file location and name. Trial balance templates are saved in the TB folder of your software. The file name consists of the client name, TB (for trial balance), and the file extension for Excel (.xls or .xlsx).

IMPORTANT: Modifying the provided template results in a corrupt import. To ensure that the information is imported correctly, the spreadsheet template provided must be used with the format unchanged.

Instructions to create a new file:

- Open a qualifying return.

- Select Import > Trial Balance Import in the toolbar, the preliminary "Trial Balance Import" dialog is opened.

- Click Create New or Open Existing.

- Choose the Excel option to Enable Macros in the "Security Warning" dialog. The Trial Balance template is displayed in Excel.

- Rows 1 through 3, of the spreadsheet, contain information pertinent to the taxpayer or business. Before continuing your data entry, update this information with the Company Name and Year End information.

- Enter the needed financial information. For more information on Direct Entry, Detail Worksheets, and the Trial Balance Import in general, view the corresponding excerpt from the Drake Tax User's Manual.

- When you are done entering financial information, click File > Save. To rename an existing file, select File > Save As and complete the information required by "Save As" dialog.

Trial Balance Columns

The columns, as presented in the template, need to appear in your file in the same order.

- Account Title – Title of the account

- Debit – Debit amounts

- Credit – Credit amounts

- Import to – Screen and line, in Drake Software, to which the debit or credit amount is imported

- Reported on – Location of the amount on the printed return

- Other information – Additional details for preparers

Import Instructions

- Open the return where you will import the trial balance information.

- Click Import > Trial Balance Import on the toolbar, the preliminary "Trial Balance Import" dialog is opened.

- Click Next.

- Enter or select the trial balance file to be imported. Use the browse feature to locate a saved file. By default, each trial balance file is an Excel file showing the client name ending in TB (trial balance).

- Select the Trial Balance Import Options. For more information on Import Options, Details for Preparers and Special Conditions in general, view this excerpt from the Drake Tax User's Manual.

- Click Next and wait for the import to be completed.

- Click Finish.

Note:

All selected data from the trial balance worksheet has been imported into the selected return. This can be seen both in the data entry screens and on the generated return.