Au

|

Option |

Description |

|

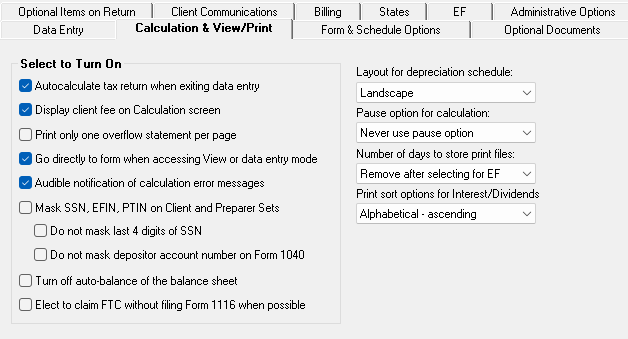

Autocalculate tax return when exiting data entry |

Automatically calculate the open return when closing the return. |

|

Display client fee on Calculation screen |

Allow the fees charged for return preparation to appear on the Calculation Results window. |

|

Print only one overflow statement per page |

Print each overflow statement on a separate page. |

|

Go directly to form when accessing View or data entry mode |

Go from a data entry screen to the corresponding form in View mode when you go to View mode. When the Data Entry button is clicked in View/Print mode, the program returns to the data entry screen. |

|

Audible notification of calculation error messages |

Be notified of EF Messages via a “beep” when calculating a return. |

|

Mask SSN, EFIN, PTIN |

Mask the taxpayer’s, preparer’s, and ERO’s identification number on printed sets. Use caution when masking SSNs and providing payment vouchers from Client and Preparer Sets. When choosing this option, be aware that the SSN is not printed on the payment voucher or estimated tax payment voucher in either the “Client” or “Preparer” sets. If a voucher is sent to the IRS or a state tax agency without the taxpayer’s SSN, the taxing authority cannot process the payment. Ensure the correct version of the voucher is used; these are found in the “Federal” and “State” sets. |

|

Do not mask last 4 digits of SSN |

Masks all digits of the taxpayer’s SSN except the last four. |

|

Do not mask depositor account number on Form 1040 |

Prevent the direct deposit account number on Form 1040 from being masked. |

|

Turn off auto-balance of the balance sheet |

Force the program to balance Schedule L for both the beginning- and end-of-year amounts. The program adjusts the capital account on Schedule L by the difference between the total assets, total liabilities, and capital before the adjustment. |

|

Elect to claim FTC without filing Form 1116 when possible |

Allow returns that are eligible for the Foreign Tax Credit (FTC) to be filed without Form 1116; the FTC instead flows to Schedule 3. |

|

Layout for depreciation schedule |

Select Portrait to produce the depreciation schedule vertically using 8.5 x 11 paper; select Landscape to produce it horizontally. |

|

Pause option for calculation |

Choose the circumstances under which the Calculation Results window appears, allowing a review of calculation results before proceeding to View mode. |

|

Number of days to store print files |

Select to store print files from 1 to 9 days, or to have them removed once the return is selected for e-file. If a return is needed after the print file is removed, recalculate the return to re-create the print file. |

|

Print sort options for Interest/Dividends |

Choose how items entered on the INT and DIV screens are sorted when printed on Schedule B: alphabetically, numerically, or not at all. |