|

Option |

Description |

|

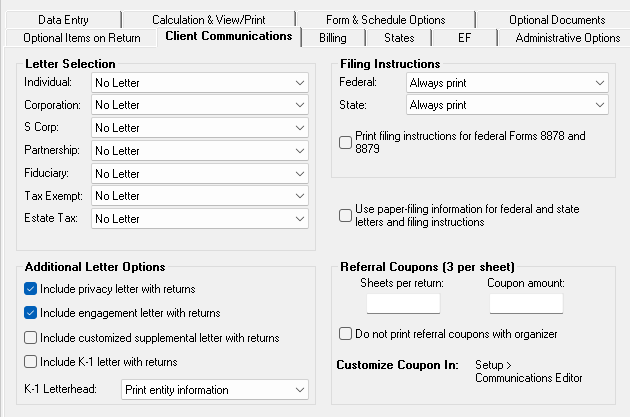

Letter Selection |

Select the Client Results letter template to be used for each return in the corresponding package. |

|

Additional Letter Options |

Include or exclude other forms and letters |

|

Include privacy letter with returns |

Print the Privacy Disclosure letter with every return. |

|

Include engagement letter with returns |

Generate an Engagement letter when the return is calculated (all packages). At the end of the letter template are spaces for client and preparer signatures. Engagement letters can also be produced prior to completing the return via Tools > Client Communications > Letters. |

|

Include customized supplemental letters with returns |

Print a customized letter that can be used for various purposes. |

|

Include K-1 letter with returns |

Print the cover letter for individual Schedules K-1 (1065, 1120-S, and 1041 packages). |

|

Filing Instructions |

Select print options for federal and state filing instructions |

|

Federal |

Choose to always print federal filing instructions (a sheet of detailed federal filing information), never print filing instructions, or print filing instructions only for paper-filed returns. Federal filing instructions include the due date of the return, form to be filed, return’s mailing address, and any tax due or refund amount. The federal instructions are listed as “Filing Instructions” in View/Print mode. Federal filing instructions are printed by default; make a global selection here or make a change for a single return using the COMM screen (Print federal filing instructions drop list). |

|

State |

Produce a sheet of detailed state filing information that includes the due date of the return, the form to be filed, return’s mailing address, and any tax due or refund amount. The instructions are listed as “ST INST.” (“ST” refers to the state abbreviation; for example, “OH INST” for Ohio instructions.) State filing instructions are printed by default; make a global change here or make a change for a single return from the COMM screen (Print state filing instructions drop list). |

|

Print filing instructions for federal Forms 8878 and 8879 |

Produce filing instructions for the applicable IRS Form 8878, IRS e-file Signature Authorization for Form 4868 or Form 2350, or Form 8879, IRS e-file Signature Authorization. |

|

Use paper-filing information... |

Produce information specific to paper-filed returns in federal and state letters and filing instructions |

|

Referral Coupons (3 per sheet) |

Offer clients discounts for referring other clients (1040 package only). Enter the number of referral sheets to print per return and the referral (coupon) amount. No coupons are printed if there is not an entry in the Sheets per return field. To customize your coupons, from the Home window menu bar, go to Setup > Communications Editor. Click Open > Individual > Individual Referral Coupon. |

|

Do not print referral coupons with organizer |

Prevent referral coupons from being printed with organizers even if a number is present in the Sheets per return field. |