An Electronic Return Originator (ERO) must complete ERO Setup in order to e-file returns, download program updates, and access the online e-file database. To access this screen, go to Setup > Electronic Filing & Account Information (ERO).

Important: Even though you can setup multiple firms, only one ERO is allowed and the ERO information must be completed before e-filing.

To set up your firm as an ERO in Drake Tax:

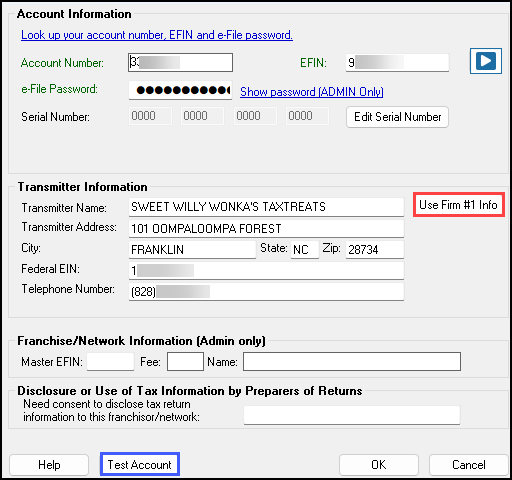

- From the menu bar of the Home window, select Setup > Electronic Filing & Account Information (ERO) to open the Electronic Filing & Account Information (ERO) dialog box.

- In the Account Information section, enter your Account Number, EFIN, and e-File Password (required), and the name, address, ZIP code, and EIN of the ERO (optional).

- In the (rare) event that you must edit your serial number, click the Edit Serial Number button and enter the changes; otherwise, leave this section blank.

- If your firm is a franchise or network, complete the Franchise/Network Information fields; otherwise, leave this section blank.

- If applicable, enter in the Disclosure or Use of Tax Information field the name of the franchise or network to which tax information must be disclosed in order to apply for bank products. (This field facilitates compliance with IRC § 7216)

- Click OK.

Click the Test Account button at the bottom of the Electronic Filing & Account Information dialog box to test the functionality of your e-file setup. If your credentials (account number, EFIN, e-file password, and serial

number) are correct, the Get Acknowledgments window is opened, and your e-file setup is tested.