The EF database is a searchable database that displays information about all returns your office has e-filed for the current tax year. Search EF Database displays information about all client files e-filed to date. Select EF > Search EF Database.

Important: Peer-to-Peer Networks Only – In order for the non-transmitting workstations to view the EF Database, the drive letter assigned to the transmitting machine must be entered in the Shared Drive Letter field in Data Location set up.

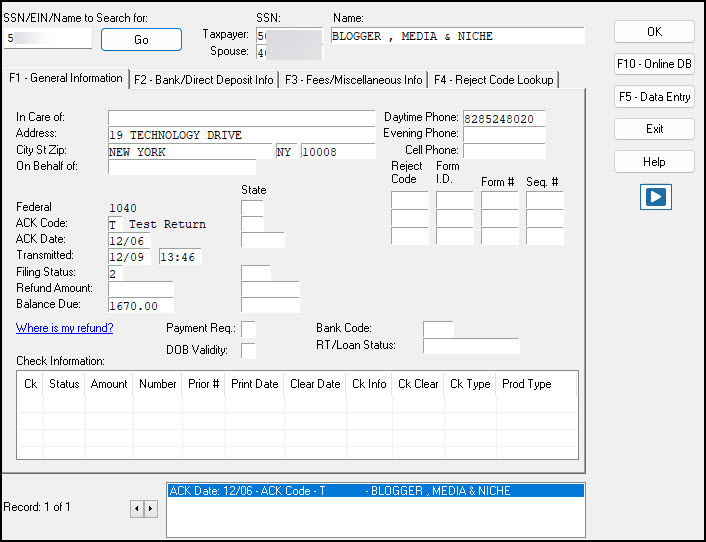

To search the EF database:

- From the Home window menu bar, click EF > Search EF Database.

- Enter an SSN, EIN, or name in the SSN/EIN/Name to Search for field of the Search EF Database window. To browse all records, leave this field blank.

- Click Go. To scroll through the records for that taxpayer, use the arrows at the bottom of the screen or press Page Up or Page Down on your keyboard.

- To close the EF database, click Exit.

Searching the Database

- Search by Specific SSN/EIN – Enter the SSN/EIN in the entry box in the top left corner and click Go. All records matching the entered SSN/EIN are displayed. The most recent record appears first. If there are multiple records for the SSN/EIN, the records are displayed at the bottom of the screen.

- Search by Name – Enter the last name or business name on which to search and click Go. The name must be a perfect match for any records to be found.

- Browse all SSNs – Leave the entry box in the top left corner blank and click Go. The first record in the database is displayed.

Multiple Record Browsing

Use PAGE UP, PAGE DOWN, or the LEFT ARROW ← and RIGHT ARROW → buttons on the bottom of the screen to browse multiple records, or browse the database.

General Information Tab

This window contains the general transmission information for an e-filed return.

- IRS acknowledgments — Federal code and date, transmission date, filing status, and refund amount or balance due are displayed in the left column. This data is from the federal “accepted” record; otherwise, the most recent transmission record for the client file is displayed.

- State acknowledgments — The State column displays the state code and date, filing status, and refund amount or balance due. This data is from the federal “accepted” record; otherwise, the most recent transmission record for the client file is displayed.

- Reject Codes — On the right side of the window are fields for the reject code, form ID, form number, and sequence number. Double-click a reject code to jump to the F4 Reject Code Lookup tab.

Bank/Direct Deposit Tab

The F2 – Bank/Direct Deposit tab contains detailed data about bank products.

- Bank product information is located on the left side of the window.

- Direct-deposit information is located on the right side of the window. This information includes amounts paid to the bank, amounts paid to the preparer, and the dates of the payments.

- Account information can be found at the bottom of the window. Account type and number are displayed for each type of direct deposit

Fees/Miscellaneous Information Tab

The F3 – Fees/Miscellaneous Info tab contains general return information about the taxpayer, the firm, and fees distribution.

Reject Code Lookup

The F4 – Reject Code Lookup tab is a search tool for accessing and understanding IRS reject codes. To look up an IRS reject code for a federal return:

- Select a federal return type.

- Enter the reject code in the Reject Code field.

- Click Go. The IRS explanation of the code is displayed in the lower box.

- (optional) Click Print to print the code explanation.

To search for a state reject code for an individual return, select 1040, and then select the state from the Category drop list before entering the reject code. To view bank product status, select Bank Codes (wording varies by bank). Explanations are displayed in the lower box. To view Bank Decline Reasons, select that option, and then choose a bank from the drop list. Explanations are displayed in the lower box. (Not all bank have codes listed.)

Note

Press F5 to open the clients return in data entry at any time.