Multi-factor authentication (MFA) is a security measure that requires users to complete a two-step process before being allowed access to Drake Tax. MFA is active by default for admin and preparer accounts.

When logging in for the first time, if the primary admin does not opt out of MFA, they must complete all processes below before being granted access to the tax program.

Setting Up MFA

To get started, first visit your MFA’s website and set up an authentication account. You (or your office administrator) might also have to set up accounts for each of your employees.

Logging In with MFA

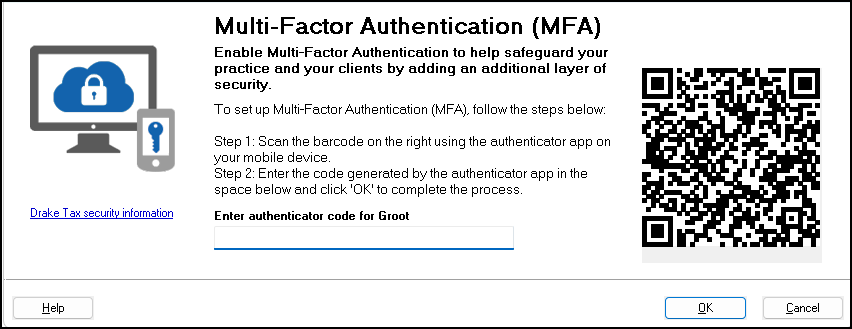

When attempting to access the program, after entering a username and password on the Login window, the preparer next sees the Multi-Factor Authentication window. Within that window is a QR code—the black-and-white square on the right side of the window. The following steps may vary by MFA provider, but in general, to continue the authentication process, the user must:

- Activate the app on their phone.

- Using the camera feature of the phone, place the QR code within the borders of the viewfinder and wait while the phone completes its scan. The authorization code is generated and displayed on the phone’s screen.

- Enter that code in the Multi-Factor Authentication window of Drake Tax and click OK.

After scanning the QR code, a profile for Drake Tax is created on the authentication app, displaying a 6-digit code. This ever-changing code, which is refreshed every 30 seconds, must be used when logging in to the tax program.

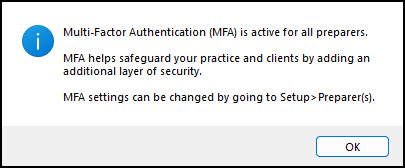

Disabling MFA

Regardless of whether the primary admin opts out of MFA during initial setup, all other Drake Tax users, whether they be added to Drake Tax 2023 or updated from Drake Tax 2022, have MFA activated by default. Only the primary admin (that is, the user who logs in to Drake Tax as “ADMIN”—not a user with administrative rights) has the ability to deactivate MFA for Drake Tax users. A message appears if you update your preparers from Drake Tax 2022 using the Setup Assistant, noting that MFA is active for all preparers.

After initial setup, the primary admin can disable MFA from Setup > Preparer(s); from there, the admin has the option to disable MFA for all preparers or on a per-preparer basis. From the Home window of Drake Tax, go to Setup > Preparer(s), and do one of the following:

- (per-preparer disable — recommended) To disable MFA for individual preparers, select the appropriate preparer from the Preparer Setup window, and below Login Information, mark the check box Disable Multi-Factor Authentication (MFA). Be sure to save your changes before returning to the main Preparer Setup window.

- (batch disable — not recommended) To disable MFA for all preparers, from the Preparer Setup window, click Security > Disable MFA for ALL preparers.