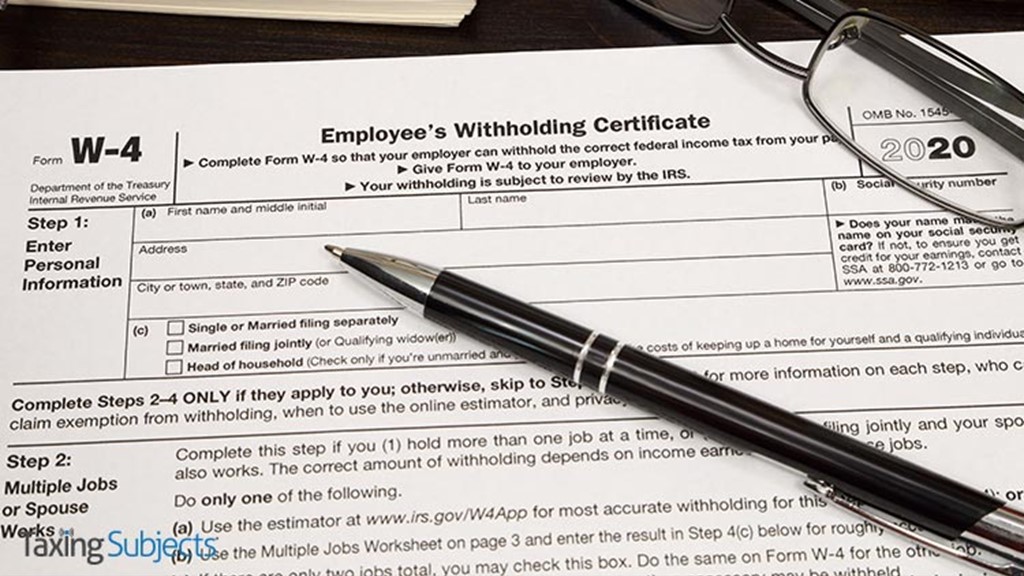

Time to Check Withholding

The last part of the year is traditionally a good time for taxpayers to check their withholding levels for the upcoming new year. That's why the Internal Revenue Service recently issued a friendly reminder.…