IRS Hosting QBI Webinar Tomorrow

Tax professionals interested in learning more about the Section 199A qualified business income (QBI) deduction can attend a webinar hosted by the IRS tomorrow afternoon.…

Tax professionals interested in learning more about the Section 199A qualified business income (QBI) deduction can attend a webinar hosted by the IRS tomorrow afternoon.…

May is National Historic Preservation Month, and plenty of organizations around the U.S. are promoting historic buildings and other important heritage sites around the country.…

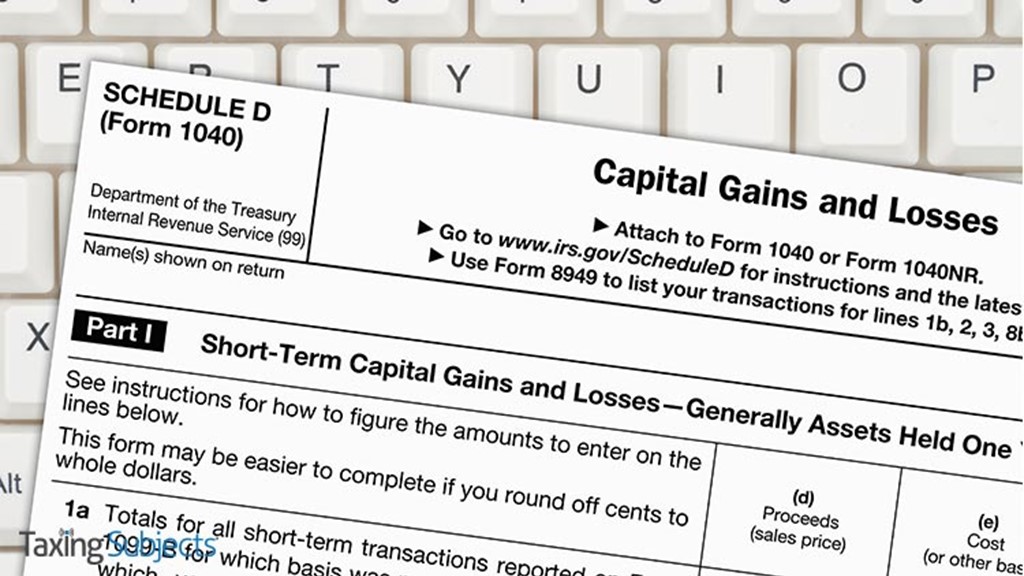

The Internal Revenue Service says it has corrected a calculation error in its 2018 Schedule D Tax Worksheet. The worksheet should have taxed capital gains at a lesser rate, as mandated by the new tax reform package, the Tax Cuts and Jobs Act, passed in 2017.…

The Internal Revenue Service has issued its final regulations updating fees for enrolled agents and enrolled retirement plan agents.…

Last week may have been National Small Business Week, but the IRS also reminded taxpayers that it was Hurricane Preparedness Week. To help taxpayers who might get caught in a natural disaster, the agency issued a series of tips to help them develop an emergency plan and preserve important documents.…

Read more about Hurricane Preparedness Week Advice from the IRS

The IRS celebrated National Small Business Week by issuing reminders and resources for the nation’s entrepreneurs. The agency closed out the week with credits and deductions that can help qualifying small businesses. And, as the IRS notes, reducing tax liability can mean healthier profit margins.…

Read more about IRS Closes National Small Business Week with Credits, Deductions

As part of National Small Business Week, the Internal Revenue Service is highlighting changes in depreciation and expensing rules for businesses.…

Read more about IRS Spotlights Depreciation, Expensing for Small Business

The Internal Revenue Service says getting a tax ID number for a business is going to be a little tougher after May 13. After that date, the IRS will require the taxpayer listed as the “responsible party” on the EIN application to have a Social Security number (SSN) or an individual taxpayer identification number (ITIN) in order to receive an Employer Identification Number (EIN) from the IRS.…

The Internal Revenue Service has issued a few reminders to small business owners to go along with this week’s observance of National Small Business Week.…

It’s National Small Business Week at the Internal Revenue Service! All this week the IRS will be emphasizing the many online resources it has available for small business owners and self-employed individuals.…