LinkBacks

LinkBacks provide a way to locate the source of data on a tax return, in other words, the data-entry screens on which the information was entered and the forms, schedules, and worksheets to which the information flows.

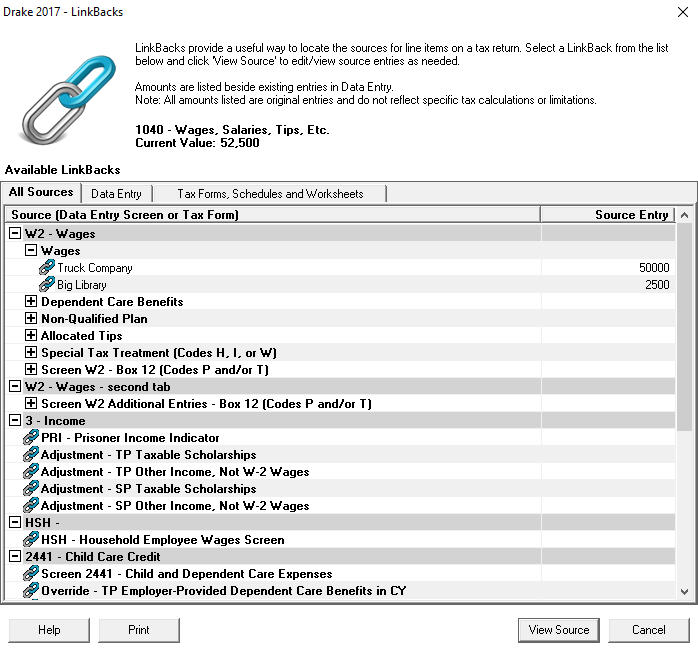

For instance, if you want to know where the data on line 7 of the 1040 was entered, view the return (Enhanced mode only), open the LinkBacks for line 7, and view a list of the screens from which the program pulls income sources that flow into the line 7 total; for instance, screen W2, screen 3 (Income), screen 2441 (Child Care Credit), screen 4137 (Tax on Tips), among others. Double-click to open a screen and go directly to the relevant line to make changes. (The line is highlighted.)

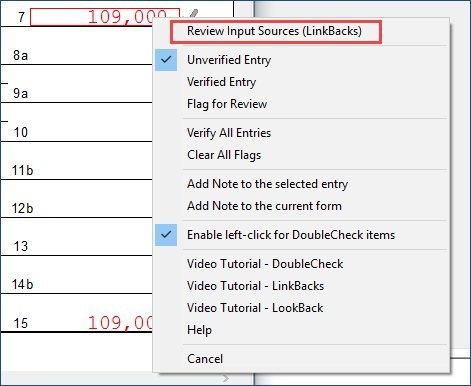

To see the LinkBacks:

- View the return in Enhanced mode.

- Right-click a text box in the form and from the right-click menu, select Review Input Sources (LinkBacks) to open the LinkBacks window.

At the top of the LinkBacks window is a note reminding you which form and which line of the form you selected. If an amount was entered or calculated for that line, the amount is also shown.

- All Sources tab – All items that appear on the other two tabs are listed here.

- Data Entry tab – The data-entry screens from which the program pulls data to complete this line of a return are listed here. If an amount was entered on one of these screens, that amount is listed to the right side of the LinkBacks window in the Source Entry column. To view a screen in data entry, select one from either the All Sources tab or Data Entry tab and click View Sources or double-click the item. The screen is opened and the line and data-entry field are highlighted in yellow.

- Tax Forms, Schedules, and Worksheets tab – The items listed on this tab are the forms that have been generated by data entry. Double-click one of the items on the Tax Forms, Schedules, and Worksheets tab and you open the actual forms that was generated.

Active LinkBacks are available for the following forms, schedules, and tax packages:

- Main forms – Federal 1040, 1041, 1120, 1120S, 1065 packages

- Schedules – A through F (federal 1040 package)

- Individual resident and nonresident main forms (all state 1040 packages)