Form 8949 Import/GruntWorx Trades

Click a Topic for more information:

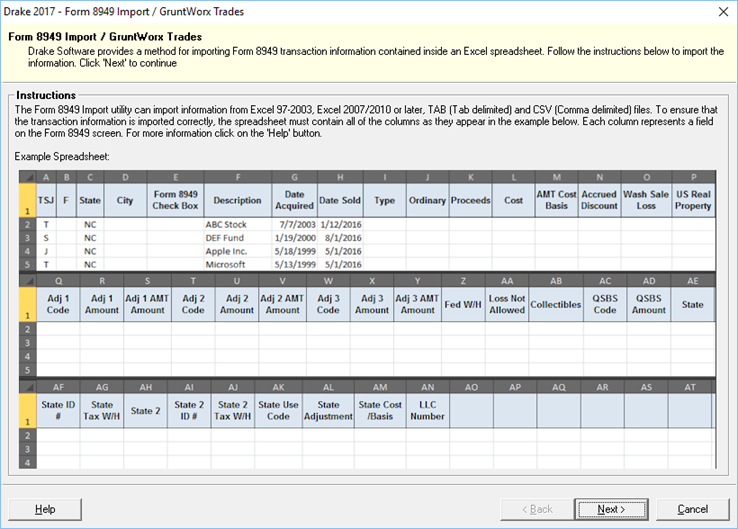

Drake Software allows you to import Excel spreadsheets, TAB (tab delimited) files, and CSV (comma separated value) files to add Form 8949 items to a specific return.

Regardless of the file type (Excel, TAB, or CSV), the tax application requires the columns to be in a specific order. Any data in your file is imported to the Form 8949. However, data entry screens have valid data requirements so it is important to plan ahead when creating your file. This section identifies the columns required, their order, and list valid data values.

IMPORTANT: Placing columns out of order or importing invalid values, may cause error messages or rejects for the associated return.

The columns are presented in the exact order they need to appear in your file.

- TSJ – This column indicates the ownership of the item.

The valid values are:

- T – The item belongs to the primary taxpayer

- S – The item belongs to the spouse of the primary taxpayer

- J – The item belongs to each equally

- Blank – Within the tax application, a blank is assumed a “T” for the primary taxpayer

- F – This column is for the Federal (F) code and identifies if the item affects the Federal return.

The valid values are:

- 0 (zero) – Excludes this item from the Federal return.

- Blank – Includes this item on the Federal return.

- State – This column indicates the state in which the gain or loss is taxable. This can be the state of residence when the item was sold, or the state where the asset was located.

- City – This column corresponds with a state that requires city codes. The acceptable city codes are determined by the state. For a current list, check the needed state’s requirements.

- Form 8949 Check Box – This column holds values of the applicable values on form 8949.

The valid values are::

- 1 – Basis reported to the IRS (Checkbox A\)

- 2 – Basis not reported to the IRS (Checkbox B\)

- 3 – Transaction not reported on Form 1099-B (Checkbox C\F)

- Leaving this field blank defaults in the selection of option 1.

- Description – Enter capital gain or loss item descriptions here as they should appear on Form 8949, Sales and Other Dispositions of Capital Assets. You can use stock ticker symbols or abbreviations to describe the property as long as they are based on the descriptions of property as shown on Form 1099-B or 1099-s (or substitute statement).

- Date Acquired – Enter the date acquired as an eight-digit number MMDDYYYY format. This date is used to determine whether the sale is sort-term or long-term.

- Enter VARIOUS if you want Various to be printed on the return. Enter S in box 2, Type of gain or loss to have it treated as short-term or L to have it treated as long-term.

- Enter INHERIT if you want Inherit to be printed on the return. Enter S in box 2, "Type of gain or loss" to have it treated as short-term or L to have it treated as long-term.

- Enter INH2010 if you want Inh-2010 to be printed on the return. Enter S in box 2, Type of gain or loss to have it treated as short-term or L to have it treated as long-term.

- Date Sold – This column indicates the date sold as an eight-digit number using MMDDYYYY format.

- Enter BANKRUPT if you want BANKRUPT to be printed on the return. If BANKRUPT is entered, the return must be paper-filed. The transaction is treated as short-term. If you want it treated as long-term, enter L in box 8, Type of gain or loss.

- Enter WORTHLESS if you want WORTHLESS to be printed on the return. To treat as short-term, enter S in box 8, Type of gain or loss. If you want it treated as long-term, enter L in box 8, Type of gain or loss.

- Enter EXPIRED if you want EXPIRED to be printed on the return. To treat as short-term, enter S in box 8, Type of gain or loss. If you want it treated as long-term, enter L in box 8, Type of gain or loss.

- Type – This column indicates the gain or loss type; S for short-term and L for long-term.

- Ordinary – This column is used to record transactions that are denoted in a currency other than the U.S. dollar, brokers must check the Ordinary check box because these transactions can be section 877 transactions to the customer. Because a customer may make an election to treat gains and losses on certain section 988 transactions a capital, the broker must also check the short-term or long-term box to indicate whether any portion of the gain or loss can be short-term or long-term. Brokers are not required to check the Ordinary check box if the security is a market discount or passive foreign investment company stock. Brokers are required to check the Ordinary check box if the security is a contingent payment debt instrument subject to the non-contingent bond method.

- Proceeds – This column indicates the proceeds from the sale of stocks, bonds, or capital assets. If only the gain amount is available, enter that amount here and no amount is Cost or Basis.

- If this is an expired option, then EXPIRED can be entered here. (Press CTRL+F to force the software to accept this entry.) Enter S in box 8, Type of gain or loss, to have it treated as short-term or L to have it treated as long-term.

- Enter WORTHLESS if you want WORTHLESS to print on the return. Press CTRL+F to force the software to accept this entry. Enter S in box 8, Type of gain or loss, to have it treated as short-term or L to have it treated as long-term.

- Loss Not Allowed – Flag field to indicate if loss is not allowed based on the amount in box 2, Proceeds from sale of stocks, bonds, or other capital assess. The value of X marks this as not allowed, leave it blank if it is allowed.

- Cost – This column indicates the cost or the basis of the item here. If only the loss amount is available, enter that amount here and no amount in Sales Price.

- Enter EXPIRED if you want EXPIRED to be printed on the return. Press CTRL+F to force the software to accept this entry.

- Enter S in box 8, Type of gain or loss, to have it treated as short-term or L to have it treated as long-term.

- AMT Cost Basis – This column indicates the cost basis for AMT purposes.

- Accrued Discount – This column is used to enter the accrued market discount amount.

- Wash Sale Loss – This column is used to report wash sale loss amount disallowed. If entered here do not reenter adjustments on the 8949 adjustments field.

- US Real Property – Select this check box if the asset was considered to be US Real Property sold by a nonresident.

- Adj 1 Code – This field indicates the adjustment 1 code.

The valid values for this field are:

- B – Basis in box 3 is incorrect

- H – Exclude some or all of the gain on the sale of home

- L1 – Nondeductible loss from a wash sale

- L2 – Nondeductible loss other than L1

- N – Received Form 1099-B or 1099-S as a nominee

- O – Adjustment not explained above

- R1 – Postponing gain because of sale of securities to buy SSBIC

- R2 – Postponing gain on securities to employee stock plan

- R3 – Rollover of gain from QSB Stock

- R4 – Rollover of gain from Empowerment Zone Assets

- T – Type of gain in box 8 of 1099-B is incorrect

- X1 – Excluding gain from sale of small business stock

- X2 – Excluding gain from sale of DC Zone asset

- X3 – Excluding gain from sale of Qualified Community Asset

- 28 – Gain or loss is from collectibles

- Adj 1 Amount – This column indicates the amount to be adjusted regarding the gain or loss, related to adjustment 1 code.

- Adj 1 AMT Amount – This column indicates the amount of AMT adjustment to the gain or loss, related to adjustment 1 code.

- Adj 2 Code – This field indicates the adjustment 2 code.

The valid values for this field are:

- B – Basis in box 3 is incorrect

- H – Exclude some or all of the gain on the sale of home

- L1 – Nondeductible loss from a wash sale

- L2 – Nondeductible loss other than L1

- N – Received Form 1099-B or 1099-S as a nominee

- O – Adjustment not explained above

- R1 – Postponing gain because of sale of securities to buy SSBIC

- R2 – Postponing gain on securities to employee stock plan

- R3 – Rollover of gain from QSB Stock

- R4 – Rollover of gain from Empowerment Zone Assets

- T – Type of gain in box 8 of 1099-B is incorrect

- X1 – Excluding gain from sale of small business stock

- X2 – Excluding gain from sale of DC Zone asset

- X3 – Excluding gain from sale of Qualified Community Asset

- 28 – Gain or loss is from collectibles

- Adj 2 Amount – This column indicates the amount to be adjusted regarding the gain or loss, related to adjustment 2 code.

- Adj 2 AMT Amount – This column indicates the amount of AMT adjustment to the gain or loss, related to adjustment 2 code.

- Adj 3 Code – This field indicates the adjustment 3 code.

The valid values for this field are:

- B – Basis in box 3 is incorrect

- H – Exclude some or all of the gain on the sale of home

- L1 – Nondeductible loss from a wash sale

- L2 – Nondeductible loss other than L1

- N – Received Form 1099-B or 1099-S as a nominee

- O – Adjustment not explained above

- R1 – Postponing gain because of sale of securities to buy SSBIC

- R2 – Postponing gain on securities to employee stock plan

- R3 – Rollover of gain from QSB Stock

- R4 – Rollover of gain from Empowerment Zone Assets

- T – Type of gain in box 8 of 1099-B is incorrect

- X1 – Excluding gain from sale of small business stock

- X2 – Excluding gain from sale of DC Zone asset

- X3 – Excluding gain from sale of Qualified Community Asset

- 28 – Gain or loss is from collectibles

- Adj 3 Amount – This column indicates the amount to be adjusted regarding the gain or loss, related to adjustment 3 code.

- Adj 3 AMT Amount – This column indicates the amount of AMT adjustment to the gain or loss, related to adjustment 3 code.

- Fed W/H – This column indicates the amount of federal tax withheld.

- Loss Not Allowed – Flag field to indicate if loss is not allowed based on the amount in box 2, Proceeds from sale of stocks, bonds, or other capital assets. The value of X marks this as not allowed, leave it blank if it is allowed.

- Collectibles – Check this box if the proceeds you are reporting in box 1d are from a transaction involving collectibles. If entered here do not reenter as an adjustment on the 8949 adjustments fields.

- QSBS Code – Qualified Small Business Stock code.

The valid values for this field are:

- Q1 – QSB stock 50% acquired after 08/10/1993 (Default)

- Q2 – QSB stock 75% acquired from 02/18/2009 to 09/27/2010

- Q3 – QSB stock 100% acquired from 09/28/2010 to 12/31/2013.

- QSBS Amount – Amount of section 1202 Gain. Enter the total amount of QSB 1202 stock here. Section 1202 allows an exclusion of up to 50% of the eligible gain on the sale or exchange of QSB stock. The section 1202 exclusion applies only to QSB stock held for more than five years. The exclusion can be up to 60% for the certain empowerment zone business stock. See Empowerment Zone Business Stock, later.

- State – Allowable state entries can be selected from the drop list for state 1. You can suppress the state with value 0, or leave the field blank.

- State ID # – This column indicates the state identification number if applicable for state 1.

- State Tax W/H – This column indicates the amount of state tax withheld if applicable for state 1.

- State 2 – Allowable state entries can be selected from the drop list for state 2. You can suppress the state with value 0, or leave the field blank.

- State 2 ID # – This column indicates the state identification number if applicable for state 2.

- State Tax 2 W/H – This column indicates the amount of state tax withheld if applicable for state 2.

- State Use Code – This column indicates state use codes; CG Carry to Idaho CG worksheet and 30 Capital gains for DC Form D-30.

- State Adjustment – This column indicates state adjustment to the gain or loss if applicable.

- State Cost Basis – An amount entered in this column indicates a difference between the state cost and other basis.

- LLC Number – Enter the number of the limited liability company for state purposes.

Note

Click Cancel at any time to stop the import process and return to the Data Entry Menu.

- From the return's Data Entry Menu, click Form 8949 GruntWorx Trade from the toolbar Import button.

- The application displays the Form 8949/GruntWorx Trade screen, click Next when you are ready to continue.

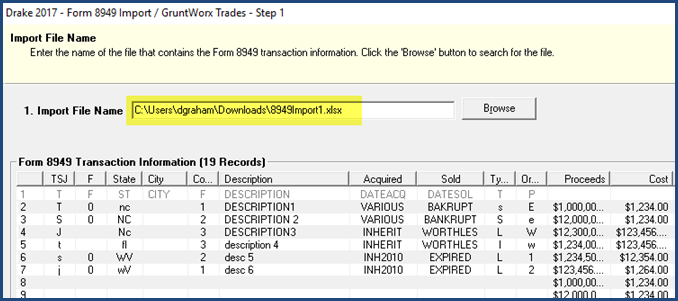

- The application displays Step 1 of the process. Type in the import file's full path and name or click Browse to select an import file. The selected file is displayed in the Form 8949 Transaction Information window along with a record count.

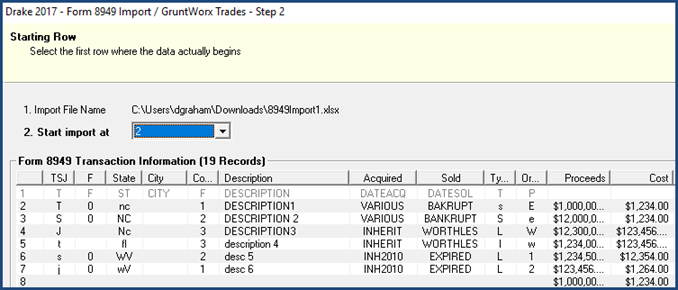

- The application displays Step 2 of the process. Select Start import at column number and click Next to continue or Back to return to the previous step. If your import file has a header, you want to exclude it from the import process and begin on row 2.

- The application displays Step 3 of the process. Review the information and when ready click Import to import the Schedule D information to the return or Back to return to the previous step(s).

Note

Click Cancel at any time to stop the import process and return to the Data Entry Menu.