|

Option |

Description |

|

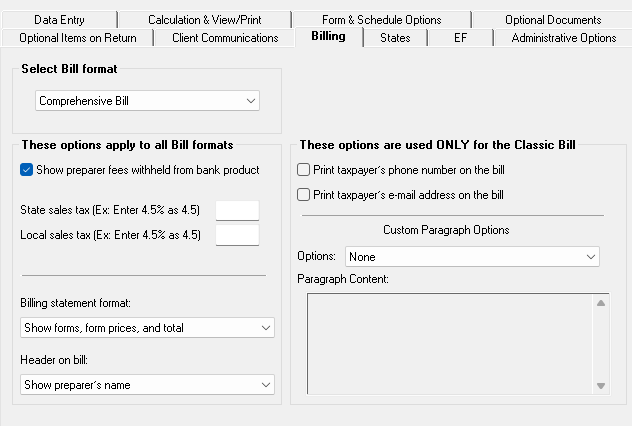

Select Bill format |

Comprehensive: Generates an itemized client bill (all packages) Summary: Creates a summarized client bill (all packages) Classic: Use the same format and features as prior years of Drake Tax. |

|

Show preparer fees withheld from bank product |

Print the preparer fees withheld from the bank product amount on the bill |

|

Sales and Local Tax |

Enter state and local sales tax rates to add to each bill; enter amounts as decimals or whole numbers. Numbers must be greater than “1.” For example, “4.5” represents a sales tax rate of 4.5%. This percentage can be adjusted per firm or per return. |

|

Billing statement format |

Choose what information is shown on the bill |

|

Only a total; does not display an itemized list of forms being billed for (Comprehensive and Classic bills only) |

|

An itemized list but no price-perform, only a total (Comprehensive and Classic bills only) |

|

An itemized list, price-per- form, and total (Comprehensive and Classic bills only) |

|

Time = spent preparing the return, multiplied by the preparer’s Hourly rate (defined in Setup > Preparers) |

|

An itemized list of charges based on forms present in the return and associated form prices (entered in Setup > Pricing) |

|

A bill by time but with the total at the bottom |

|

|

|

|

Header on bill |

|

|

Options for Classic Bill Only |

|

|

Print taxpayer's phone number on the bill |

Print the taxpayer’s phone number (entered on screen 1) on the bill. |

|

Print taxpayer's email address on the bill |

Print the taxpayer’s email address (entered on screen 1) on the bill. |

|

Custom Paragraph Options |

Have a custom paragraph printed at the top or bottom of the customer’s bill. |

|

Paragraph Content |

Write a custom paragraph to include on every customer’s bill. |