|

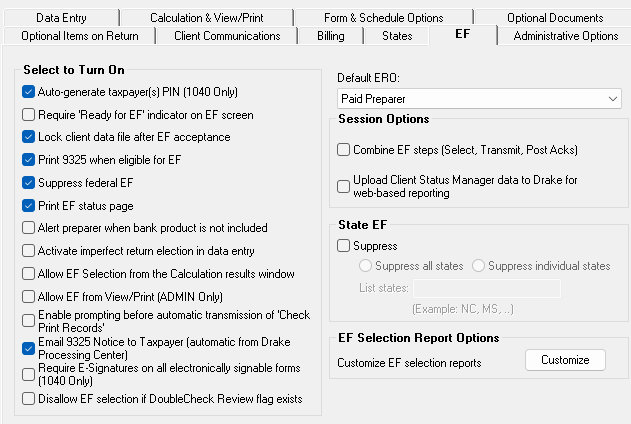

Option |

Description |

|

Auto-generate taxpayer(s) PIN |

Assign a randomly generated PIN to each taxpayer and spouse |

|

Require ‘Ready for EF’ indicator on EF screen |

Require the Ready for EF indicator on the EF screen to be marked before a return can be selected for e-file. |

|

Lock client data file after EF acceptance |

Generates a reminder that the return has been filed and accepted when next you open the file. |

|

Print 9325 when eligible for EF |

Print Form 9325, Acknowledgment and General Information for Taxpayers Who File Returns Electronically, for every eligible return. |

|

Suppress federal EF |

Prevent e-file of federal return. |

|

Print EF status page |

Generate an EF Transmission Status page (“EF Status” in View/Print mode) for any return that is eligible for e-file. |

|

Alert preparer when bank product is not included |

Alert the preparer via an EF Message that a return does not include a bank product. |

|

Activate imperfect return election in data entry |

Activate Imperfect Return Election check box on EF screen in data entry. |

|

Allow selection for EF from the ‘Calculation Results’ screen |

Allow the preparer to send the open return directly to the e-file queue via the Calculations Results window. |

|

Allow EF from View/Print (ADMIN Only) |

e-File a return directly from View/Print mode by clicking the eFile Taxpayer icon on the View/Print mode toolbar. (All EF Messages must be cleared.) The file is transmitted, and a “P” or “B” ack (acknowledgment) is returned. |

|

Enable prompting before automatic transmission of ‘Check Print Records’ |

Allow program to notify you before it transmits the Check Print records. |

|

Email 9325 Notice to Taxpayer (automatic from Drake Processing Center) |

Form 9325, Acknowledgment and General Information for Taxpayers Who File Returns Electronically, is automatically emailed to taxpayer when return is accepted. (Client’s email address must be present on screen 1.) Override this selection on screen EF using the Email 9325 notice to taxpayer drop list. |

|

Require E-Signatures on all electronically signable forms (1040 only) |

Require all preparers to take advantage of Drake’s e-Signature capabilities. Override this selection on the EF screen. |

|

Disallow EF for DoubleCheck flag |

Require all DoubleCheck flags in View/Print mode to be removed before the return can be sent to the e-file queue. (See “DoubleCheck and LinkBacks” |

|

Default ERO |

Choose a preparer number, Paid Preparer, or None to indicate what ERO name should appear on all applicable return documents. Override this selection on screen 1 (ERO # field) or PREP (FEDERAL PREPARERS section). |

|

Combine EF steps (Select, Transmit, Post Acks) |

Combine all e-file steps. From EF > Transmit/Receive, clicking Send/Receive transmits selected returns, picks up new acknowledgments, and processes acknowledgments in one step. |

|

Upload Client Status Manager data to Drake for web-based reporting |

Send Client Status Manager (CSM) data automatically to the Multi-Office Manager (MOM) during the EF process. |

|

State EF |

Suppress e-file for all state returns, or select individual states to always suppress. |

|

EF Selection Report Options |

Customize EF selection reports by specifying which columns (such as SSN/EIN, client name, refund/balance due, etc.) should be included in the EF selection report. |