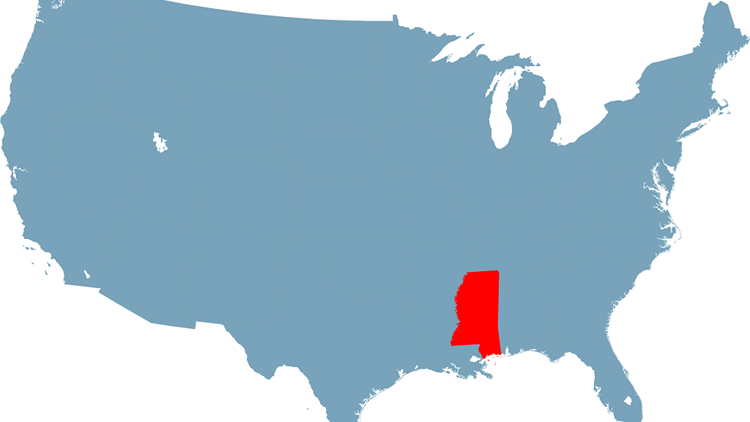

Mississippi Gets Hurricane Ida Tax Relief

The Internal Revenue Service announced that Mississippi will now receive tax relief in the wake of Hurricane Ida, delaying some filing and payment deadlines for affected taxpayers. The Magnolia State joins a list that currently includes Louisiana, New Jersey, and New York.

“The IRS is offering relief to any area designated by the Federal Emergency Management Agency (FEMA) as qualifying for individual or public assistance,” the IRS says. “Currently, individuals and households affected by Hurricane Ida that reside or have a business in all 82 counties and the Mississippi Choctaw Indian Reservation qualify for tax relief.”

What deadlines are extended by Hurricane Ida tax relief?

The Hurricane Ida tax relief generally extends filing and payment deadlines for individuals and businesses that were due on or after August 28, 2021, until November 1, 2021, including:

- TY 2021 quarterly estimated income tax payments due September 15, 2021

- TY 2020 calendar-year partnerships and S corporation extensions due September 15, 2021

- TY 2020 calendar-year corporation extensions due October 15, 2021

- TY 2020 individual return filing extensions due October 15, 2021

Taxpayers owing certain penalties are also benefitting from this relief: “Penalties on payroll and excise tax deposits due on or after August 28, 2021 and before September 13, will be abated as long as the deposits are made by September 13, 2021.”

However, tax payments due May 17, 2021, and quarterly payroll and excise tax returns due November 1, 2021, will not be extended.

How do taxpayers in Mississippi receive Hurricane Ida tax relief?

The Hurricane Ida tax relief is automatic for Mississippi taxpayers living in the federally declared disaster area, meaning affected taxpayers don’t have to do anything to receive it. That said, qualifying taxpayers might still receive late notices related to the extended deadlines. In those situations, the IRS says the taxpayers need to “call the number on the notice to have the penalty abated.”

But taxpayers don’t necessarily have to live in the disaster area to receive the tax relief.

“The IRS will work with any taxpayer who lives outside the disaster area but whose records necessary to meet a deadline occurring during the postponement period are located in the affected area,” the agency explains. “Taxpayers qualifying for relief who live outside the disaster area need to contact the IRS at 866-562-5227. This also includes workers assisting the relief activities who are affiliated with a recognized government or philanthropic organization.”

Are there any additional resources for Hurricane Ida victims?

The IRS provides links to two additional resources that can help victims of Hurricane Ida:

- Publication 547, Casualties, Disasters, and Thefts includes instructions for claiming uninsured or unreimbursed losses from the hurricane on the current- or prior-year tax return

- gov includes assistance forms, instructions for locating local resources, and other disaster recovery information

Follow the below link to read the full IRS press release.

Source: IR-2021-180