Drake Accounting®: How do I generate and e-file a 94x series tax return?

Payroll tax returns are current tax year calculations of the client's tax liabilities based on payroll generated in Drake Accounting®. Use the 20YY Drake Accounting® program to generate 20YY 94x series tax returns.

To generate 94x tax returns “on the fly” (without having to set up employees or enter payroll information), see Related Links below.

When Drake Accounting® is set up to e-file 94x series tax returns, saving the return generates the e-file and a printable copy for your records.

If Drake Accounting® is not set up to e-file 94x series tax returns, only the printable copy is generated. To set up a client for 94x e-filing, setup must be complete on Firm > Firm Information Setup and Client > Edit > e-File Options. When this set up has been completed, the 94x form will show a "THIS FORM HAS BEEN SELECTED FOR EFILING" watermark.

Watch the Setting up 94X e-Filing and e-filing 94X Returns videos for a demonstration of the detailed steps below.

To produce a 94x tax return:

- Go to Employees > Federal Forms.

- With Forms 94x selected as the Form Type, select the desired 94x tax return from the Form drop list.

- Use the Source drop list to select to use either tax deposit information or payroll information. Select Tax Deposits if tax deposit information has been entered into Drake Accounting® for the entire period covered by the 94x return and you wish to bring that information into the return. Select Payroll if tax deposit information wasn’t entered for the period or is incomplete for the period. If Payroll is selected, you will need to enter deposit information onto the form.

- Use the Quarter drop list to select the quarter that the 94x tax return is for, if applicable.

- For Forms 941, 941-SS, and 941-PR, Schedule B displays when the Deposit Frequency is set to Semi-Weekly, but only prints when the Total Taxes After Adjustments for the quarter is at least $2,500. To force printing of Schedule B when the Total Taxes After Adjustments amount is less than $2,500, select Print Sch B if return is less than $2,500 in the Print Options section when producing the 941 tax return.

- Form 941, Line 1 will only include employees who have at least one paycheck with a pay period range that includes the 12th day of the third month of the selected quarter (March 12th for Q1, June 12th for Q2, Sept 12th for Q3, and December 12th for Q4). Line 1 does not take into account the check date, and it will only take into account the pay period beginning and end dates to determine if the employee should be included in the employee count.

- In DAS 20, an additional worksheet is produced with Form 941/941-PR/941-SS for quarters 2-4 for the Sick and Family Medical Leave Wages and the Employer Retention Credit. In DAS21, there are additional worksheets (1-4) produced with Form 941/941-PR/941-SS for the Sick and Family Medical Leave Wages and the Employer Retention Credit.

- Override Calculated Data — Drake Accounting® displays 94x returns with both calculated and non-calculated data fields. Select this option to allow you to overwrite both types of data fields. When this check box is cleared, calculated fields on the form are grayed out. Certain fields on the worksheet pages will still stay grayed out when this checkbox is checked.

- When this option is selected, edits will not be saved if you process the 94x returns again.

- Once all selections have been made, the return is displayed. Use the page tabs at the top left of the displayed form to navigate to the various pages of the return. Use the plus (+) and minus (-) buttons to zoom in and out.

- Select the preparer of the return from the Preparer’s Name drop list of the Paid preparer’s use only section of the return (if appropriate). Preparers display in the list once they’ve been entered in Firm > User Setup > Preparer Information tab.

- Click Save/Print to save and display the return in PDF format. Then click the printer icon to print the return. If you do not wish to print the return at this time, click Save instead. If you wish to print the return at a later date, you can locate the return under Tools > Review Reports.

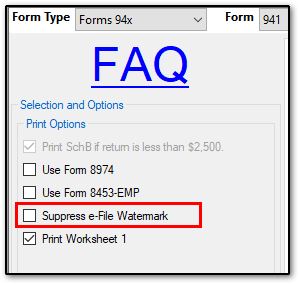

A "Suppress e-File Watermark" option allows you to remove the watermark from the form:

Transmitting to IRS:

Once the tax return is saved, it can be transmitted to the IRS by going to e‑Filings > 94x > Transmit 94x Forms, selecting the type of 94x tax return to transmit, then selecting the specific return. Only the 94x tax returns that are approved for e-filing are listed.

- The IRS uses the amount on the Balance Due line of 94x tax returns when debiting the bank accounts specified for making electronic payments for these returns. If using Drake Accounting®’s online payment feature, it is very important to verify the Balance Due amount on the 94x tax return prior to e-filing the return. See the online payment tab under Client > Edit > Online Payment for information on setting up this feature.

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!