What forms

are being transmitted when I e-file a return?

When a return is completed, there can be a long list of forms

and worksheets as a result of the numerous calculations, credits, schedules, previously filed

extensions,

future estimations, and various preparer to client communications. At this time, there is no

expressed list detailing the contents of an e-file transmission, however, it is not to difficult to

determine what will be included. Simply put, the transmission only contains what is required per IRS Schemas.

For detailed information on Schemas, see IRS Schemas and business rules.

Communication

Our development teams communicate with the IRS and State Departments consistently to stay

up to date regarding the information required for processing returns. This allows Drake Software

to make sure that the information you enter is presented in the professional manner you expect, while also ensuring that the transmission does not include any unnecessary information. When the return is ready to be e-filed, the IRS and/or State Department only receive what they need.

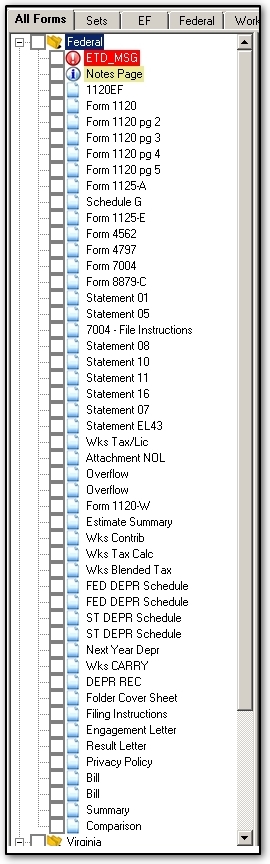

View Mode and Sets

On the left, we can see the Federal portion of

the All Forms list, as shown in

Enhanced view. The list of information is quite extensive, however, not all of the forms will be transmitted with the

return. In fact, much of the list is for record keeping and substantiation.

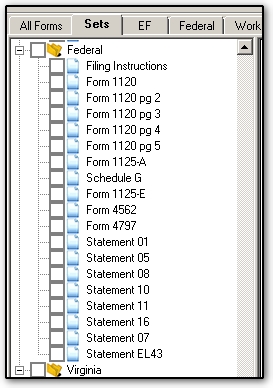

On the right we can see the Federal Set.The Sets tab shows you an organized selection of forms. The Federal Set

displays forms that the IRS would require if they were to be mailed. In this example, less than half

of the forms from the Federal Forms list

are present within the Federal Set. This is because the list provides all of the documentation for the

calculations of the outcome, as well as communications to the taxpayer, and

projections.

In the example above, a corporate return is shown. The forms that are

required are:

- Form 1120,

substantiated by accompanying forms and schedules

- 1125A

- Cost of

goods

- 4797 - Sales of business assets

- 4562 - Depreciation

- 1125-E and Schedule G - information regarding other individuals or

entities involved.

- There are also

'Statements' which provide a required

itemization of some items, such as Other Expense.

All of these items would be included in an e-filed

transmission.

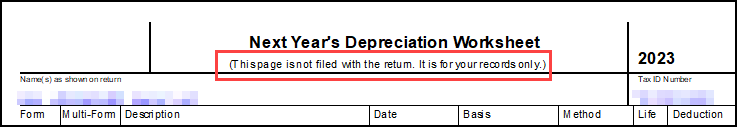

Forms

Generally speaking, if you are looking to see if a specific form is

included, the answer may be within the header of the form or worksheet. Some forms and

worksheets will specify if they should or should not be sent. If the

IRS requires the form in a paper-file situation, generally that information will be

transmitted with the return. Let's take a

look at some of the forms from the list that were not included in

the set.

- Communications/letters (not shown)

- Items, such as the result letter and bill, are produced

exclusively for your client. There is no need to consider those as they are not included in the

transmission.

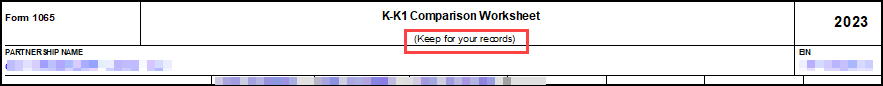

- Detail listings, and

Worksheets

- Some pages are marked "Keep for your

records." These forms, worksheets, or schedules are not required by the IRS or state DOR. Therefore, they are not included in

any e-file transmission.

- These forms are typically:

- Supporting details for items reported elsewhere, such

as the Depreciation Detail

or

- Items intended to provide useful information for preparing future tax returns, such

as NOL Deductions, including current and prior year amounts available and

used. This will assist with next year's return preparation.

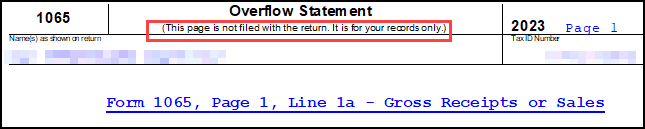

- Overflow Statements

- Most commonly produced from detail worksheets, these statements provide an itemized

list with a calculated total.

- If the worksheet was not required, only the total flows to the line

referenced and the statement is retained for record keeping purposes.

- If the worksheet is

required by IRS or the state DOR, the details will be included with the e-filed return.

Overflow Statements and Detail

Worksheets

Generally, Overflow Statements are not included

with the transmission. The total calculated on the statement flows to the form and field for which it was

created. The resulting statement is for your records only (unless otherwise

specified).

A common source of Overflow Statements are Detail Worksheets. Detail Worksheets are created by selecting a field in data entry and

pressing CTRL + W, double clicking on the

field, or right clicking in the field and selecting "Add Worksheet." Some fields

require a detail worksheet, and will open the worksheet window when you begin typing in the field.

One such field is in an individual return on the C screen: Schedule C, Other

Expenses, line.

Detail worksheets that get

e-filed to the IRS will say "IRS requires this field to have a worksheet". The Schedule C, Line 27A - Other

Expenses worksheet is Part V, located at the bottom of page 2.

Detail

worksheets that do not get e-filed will just say "Detail Worksheet" at the top of the

screen.

This detail

worksheet will produce a "keep for your records" Overflow Statement that will add the lines together and produce a total on Schedule

C, line 1.

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!