Why do I see itemized deductions or state and local taxes on the Comparison page when the taxpayer took the standard deduction?

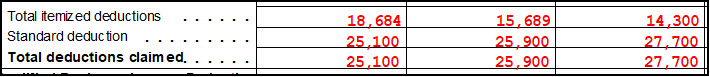

Starting with Drake23, the Comparison page shows both the itemized deduction and standard deduction amounts, along with which type of deduction was claimed on the return.

This page is for informational purposes only and does not affect the results of the tax return. If you do not want to see these amounts printed, use the check box Do NOT print itemized deductions on the Tax Return Comparison if claiming the standard deduction on the PRNT screen.

Note: Since this feature is new for Drake Tax 2023, itemized deduction amounts from 2021 and 2022 must be entered on screen COMP directly, if desired. Itemized deduction amounts will be updated automatically to Drake Tax 2024.

State and Local Taxes

The figure displayed for state and local taxes is calculated automatically based on entries made in the return. This is done even if the taxpayer's resident state does not have state income taxes as this amount may be calculated from the general sales taxes instead. On the PRNT screen, you can choose Yes for Produce Schedule A (PRNT screen)

and review what would have been allowed on the itemized deductions

schedule if the taxpayer had chosen to itemize instead of taking the standard

deduction. To review the sales tax calculation, go to the STAX screen and mark the box Print the General Sales Tax worksheet; Wks STAX shows in View/Print mode.

See KB 15833 for information about the SALT calculation.

For more information about the Comparison sheet, see KB 10855.

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!