What options are available to customize the Drake Tax program?

You can customize Drake Tax by going to Setup > Options and selecting from the options on the available tabs. Note that some options vary depending on the year of Drake Tax being used and your preparer security settings/rights.

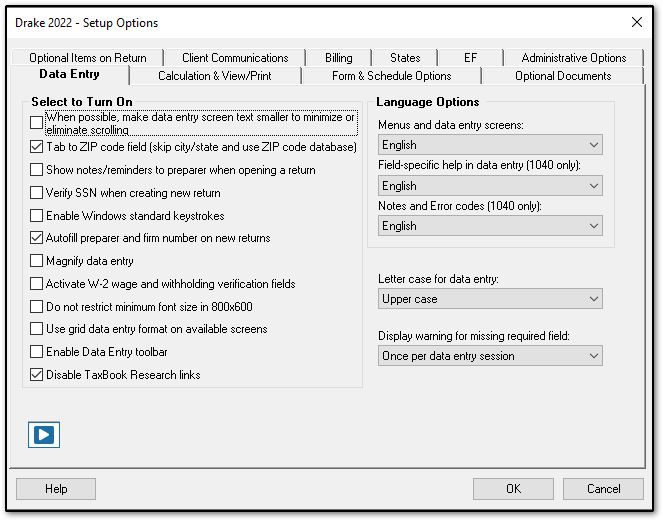

Data Entry tab

- When possible, make data entry screen text smaller to minimize or eliminate scrolling - see KB 13193 and 16426

- Tab to ZIP code field (skip city/state and use ZIP code database)

- Show notes/reminders to preparer when opening a return - see KB 12486

- Verify SSN when creating new return

- Enable Windows standard keystrokes - see KB 12130

- Autofill preparer and firm number on new returns

- Magnify data entry - When you click inside a data entry box, the field and text increase in size to allow you to better see the field and your entry.

- Activate W-2 wage and withholding verification fields - see KB 10932

- Do not restrict minimum font size in 800x600

- Use grid data entry format on available screens - see KBs 11505, 13144, and 13127

- Enable Data Entry toolbar - see KB 14287

- Disable TaxBook Research links - see KB 16943

- Language Options (English or Español) - see KB 15020

- Menus and data entry screens

- Field-specific help in data entry (1040 only)

- Notes and Error Codes (1040 only)

- Letter case for data entry (upper case or mixed case) - see KB 16990

- Display warning for missing required field

Calculation & View/Print tab

- Auto-calculate tax return when exiting data entry - see KB 14201

- Display client fee on Calculation screen - see KB 11865

- Print only one overflow statement per page - see KB 13251

- Go directly to form when accessing View or data entry mode

- Audible notification of calculation error messages - see KB 11692

- Mask SSN, EFIN, PTIN on Client and Preparer sets - see KB 14304

- Do not mask last 4 digits of SSN

- Do not mask depositor account number on Form 1040

- See KB 14876 for additional masking options available in view mode.

- Turn off auto-balance of the balance sheet

- Elect to claim FTC without filing Form 1116 when possible - see KB 17563

- Layout for depreciation schedule

- Pause option for calculation - see KB 11692

- Number of days to store print files - see KB 10379

- Print sort options for Interest/Dividends

Form & Schedule Options tab

- Print Schedule A only when required

- Print Schedule B only when required

- Print Schedule 4562 only when required

- Print Schedule 6251 only when required

- Next-year depreciation schedule - see KB 11423

- W-2/1099 forms

- Print two W-2/1099-Rs per page - see KB 11386.

- Carryover Worksheet - see KBs 10863 and 14073

- Print page 2 of Schedule K-1 for 1041 and K-1 codes for 1120S and 1065 - see KB 11677

- Print ES vouchers only when screen ES indicates - see KBs 10824 and 14487

- Always show reason for no EIC - see KB 10886

- Always show tax computation worksheet - see KB 10298

- Print shareholder's/partner's adjusted basis worksheet - see KB 12275

- 1040-SR Suppress drop list - see KB 16444

- Form 8879 bank account options - see KB 10475

- W-2 list if greater than __

- W-2G list if greater than __

- 1099-M list if greater than __

- 1099-NEC list if greater than __

- 1099-R list if greater than __

- Federal Withholding Summary - see KB 14288

- List of Dividends and Interest if more than __

- K-1 list (bus. returns only) if greater than __

Optional Documents tab

- Folder coversheet

- Prior year(s) comparison form - see KBs 10855 and 18435

- Return summary

- Bill summary

- Labels

- Taxpayer address drop list

- Do not print taxpayer envelope sheet with organizer

- IRS service center address

- State address

- City address

- K-1 address

- Firm address

- Do not print firm envelope sheet with organizer

- Estimated payment coversheet

Optional Items on Return tab

- Date on return - see KB 10633

- Print dates for taxpayer and spouse signatures (excludes 1040)

- Taxpayer phone number - see KB 10209

- Taxpayer email address

- Automatically calculate penalties and interest on returns filed after the due date. Drake Software automatically updates quarterly interest rates when needed. See KB 12085

- Third party designee drop list - see KB 10820

Client Communications tab

- Letter selection by return type - see KBs 10569 and 12697

- Include privacy letter with returns - see KB 11625

- Include engagement letter with returns - see KB 14161

- Include customized supplemental letter with returns - see KB 14869

- Include K-1 letter with returns - see KB 10980

- K-1 Letterhead options

- Filing Instructions options - see KB 11208

- Federal

- State

- Print filing instructions for federal Forms 8878 and 8879

- Use paper-filing information for federal and state letters and filing instructions - see KB 16438

- Referral Coupons (3 per sheet) - see KB 12159

- Sheets per return

- Coupon Amount

- Do not print referral coupons with organizer

Billing tab - see KB 13392

- Select Bill format

- Show preparer fees withheld from bank product - see KB 11865 for fee details.

- State sales tax

- Local sales tax

- Billing statement format - see KB 13939

- Header on bill

- Print taxpayer's phone number on the bill

- Print taxpayer's email address on the bill

- Custom Paragraph options

States tab

- Choose a state for state-specific options.

EF tab

- Auto-generate taxpayer(s) PIN (1040 only) - see KB 13284

- Require "Ready for EF" indicator on EF screen - see KB 10398

- Lock client data file after EF acceptance - see KB 12280

- Print 9325 when eligible for EF - see KB 10847

- Suppress federal EF - see KB 10081 for additional options for suppressing EF.

- Print EF status page

- Alert preparer when bank product is not included - see KB 10797 for info about bank products.

- Activate imperfect return election in data entry - see KB 10429

- Allow EF Selection from the Calculation results window

- Allow EF from View/Print (ADMIN only)

- Enable prompting before automatic transmission of "Check Print Records" - see KB 10180

- Email 9325 Notice to Taxpayer (automatic from Drake Processing Center) - see KB 10847

- Require e-Signatures on all electronically signable forms (1040 only) - see KBs 12518 and 13097

- Disallow EF selection if DoubleCheck Review flag exists - see KBs 13765 and 13861

- Default ERO - see KB 10820

- Combine EF steps (Select, Transmit, Post Acks) - see KB 10288

- Upload Client Status Manager data to Drake for web-based reporting - see KB 10800

- State EF Suppress options - see KB 10081 for additional options for suppressing EF.

- Customize EF Selection Reports also see KB 13207

Administrative Options tab (admin level logins only)

- Use customized data entry selection menu - see KB 13245

- Customize user-defined data entry fields - see KB 12197

- Allow preparer access to same-firm returns only

- Use customized flagged fields on all returns - see KB 13905

- Apply current-year Admin flag settings when updating from prior year - see KB 10846

- Authorize/Request the disclosure of certain taxpayer information

- Print all due diligence assistance documents - see KB 14268

- Require due diligence assistance screens to be completed - see KB 14291

- Enable logged in preparer's Personal Client Manager - see KB 10131

- Charge ALL taxpayer's the same fees (You MUST read the program help before choosing this option) - see KB 11000.

- Automatically password protect files - see KB 13098

- Default password - see KB 13098

- Return Status Notification Programs see ABCvoice.

- Select program drop list

- Generate consent forms with tax return

- Require contact information on returns

- Include password protected returns in reports (ADMIN only) - see KB 14180