Why is the Balance Sheet beginning or end of tax year blank? Can I force the amounts to print?

Initial Return

A partnership, corporate, or tax exempt organization return that has the box Initial Return marked on screen 1 should not have any beginning balances on the Balance Sheet (Schedule L in a 1065/1120-S/1120 or Part X in a 990), so the software blanks out this column.

An S corporation return that has:

- the Date of Election as an S corporation and the Date incorporated both equal to the beginning of the tax year (January 1st for calendar years, or the fiscal year beginning date for fiscal year returns), and

- the First year as an S corporation box selected

should also not have any beginning balance on the Schedule L.

If you have entered beginning balances in either a 1065, 1120-S, or 990, the software produces Notes page 349.

Final Return

Similarly, a return that is marked Final Return on screen 1 should have no ending balances on Schedule L, so the software blanks out that column.

If ending balances have been entered in a 1065,1120, 1120-S, or 990, the software produces Notes page 342.

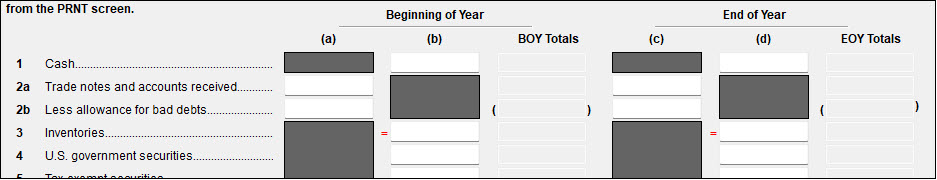

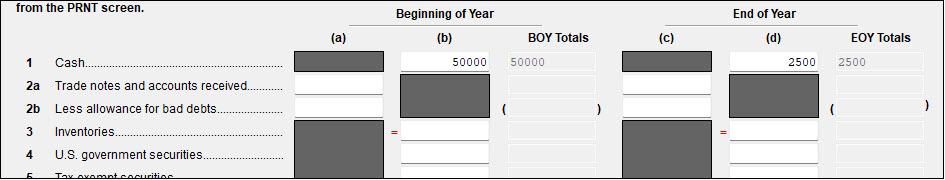

Beginning with Drake14, reconciliation totals are displayed on the L data entry screen.

If changes are made, the return must be re-calculated for the new numbers to display.

Force Print Options

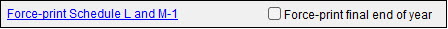

If it is a final return, the EOY column is “zeroed out,” however, there may be cases where the preparer needs this information. Select the Force-print final end of year at the top of the L screen (1065/1120/1120-S).

If Schedule B, question 4 was marked yes, but you need to see amounts in view mode, choose the option Force Schedules L, M-1, M-2, & K-1 Section L on the PRNT screen.

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!