How can I generate Form 8582 in a 1040 return?

If losses from passive activities are involved, Form 8582 is produced when necessary to limit losses based on IRS guidelines. For example, if the taxpayer's MAGI is too high, the losses may need to be limited. More information is available in Publication 925 and in the Form 8582 Instructions.

The only data entry point for Form 8582 is the 8582 screen, which allows you to override figures for the Wks MAGI, a worksheet that determines the modified adjusted gross income (MAGI) for line 7 of this form.

If Form 8582 does not appear in view mode, check if:

- There is a loss from a passive activity such as Schedule E or K-1.

- Form 8582 is not required if there is a net gain.

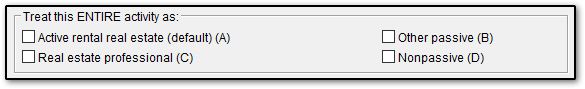

- The activity code on Schedule E or K-1. If codes C or D are selected, information does not flow to Form 8582*. On the E, K1P, K1F, or K1S screen use the checkbox treat this entire activity as:

Review the field help F1 for more info on each of these selections.

- The checkbox The activity was disposed of during taxable year is selected. A loss is not limited and Form 8582 is not required when an activity was fully disposed of.

To force Form 8582 to print, open the PRNT screen and select the option Produce Form 8582.

If the taxpayer's losses on Schedule E should be limited to the at-risk basis in the activity, use the 6198 screen. Use the FOR and MULTI-FORM CODE boxes to link the E screen with the 6198 screen. A 6198 At Risk and 6198 At Risk continued tab is available on the K1P, K1S, or K1F screen, if needed for at risk limitations from a pass-through entity.

*An exception is when the rental was a passive activity in a prior year, but is C or D (non-passive) in the current year. In this situation, the rental is considered to be a "former passive activity," and some information (such as prior unallowed passive operating losses) will carry to Form 8582. Per the Form 8582 Instructions:

"If a rental real estate activity isn’t

a passive activity for the current year,

any prior year unallowed loss is treated

as a loss from a former passive activity."

"A former passive activity is any activity

that was a passive activity in a prior tax

year but is not a passive activity in the

current tax year. A prior year unallowed

loss from a former passive activity is

allowed to the extent of current year

income from the activity.

If current year net income from the

activity is less than or equal to the prior

year unallowed loss, enter the prior year

unallowed loss and any current year net

income from the activity on Form 8582

and the applicable worksheets.

If current year net income from the

activity is more than the prior year

unallowed loss from the activity, enter

the prior year unallowed loss and the

current year net income up to the

amount of prior year unallowed loss on

Form 8582 and the applicable

worksheets.

If the activity has a net loss for the

current year, enter the prior year

unallowed loss (but not the current year

loss) on Form 8582 and the applicable

worksheets"

Generally, rental real estate activities with active participation flow to Form 8582, Part 1, line 1, and the calculation is shown on Wks 85821, however, if the return is being filed as Married Filing Separate (MFS), worksheet 3 is used and it flows to Form 8582, Part 1, line 3 instead. This is because the Form 8582 Instructions specify that "Married individuals who file separate returns and lived with their spouses at any time during the tax year don’t qualify under the active participation rule and must use Worksheet 3 instead of Worksheet 1." This also applies to someone filing a 1040-NR with filing status of MRS (previously status 5). See note 402 if the taxpayer did not live with the spouse as an additional selection must be made on screen 1 to indicate this.

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!