How can I import Capital Gains and Losses, Form 8949, or Form 1099-B into Drake?

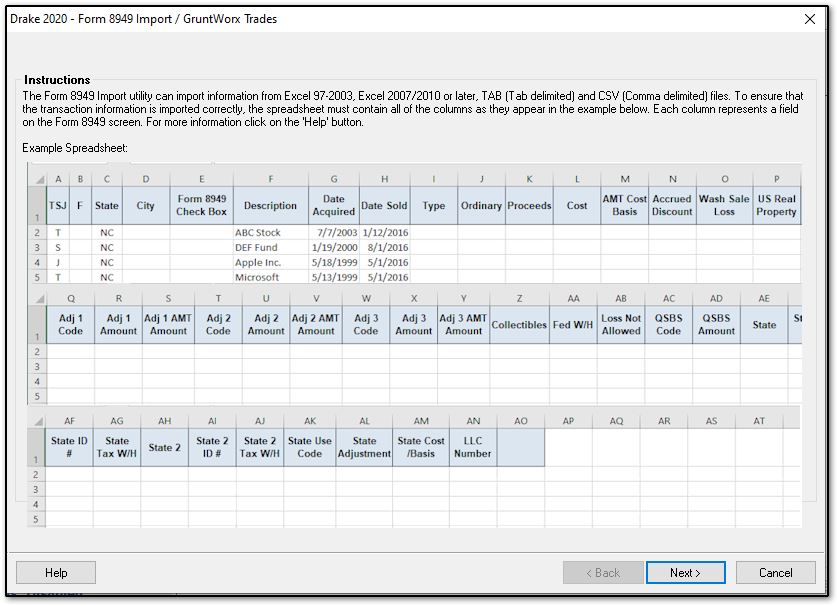

You can import information into Drake Tax by using the Form 8949 Import / GruntWorx Trades utility. You can import transaction information from Excel 97-2003 and Excel 2007/2010 or later, TAB (tab delimited), or .CSV (comma delimited) files. After import, each transaction appears on a separate 8949 screen. For a successful import, the data must be correctly formatted (GruntWorx Trades are already properly formatted). A blank Excel workbook (*.xls) with a header row and date fields formatted as text is available for download (see Attachments at the bottom of this page).

Note: When using the blank workbook to import data, be sure to use the correct Attachment below for the tax year that you are working in.

Start by reading the Help screen instruction. In the client’s tax return, click the Import button on the toolbar and select Form 8949 Import / GruntWorx Trades. Click the Help button in the lower-left corner of the dialog box to display the Help screen instructions about using the import utility. You may want to print the instructions for easy reference (5 pages).

Watch the videos 8949 Import Options and 8949 Import Tool for more details about the process.

For the information to import correctly:

- In an Excel workbook, the import data must be on the first spreadsheet in the workbook. View the workbook and make sure the sheet to be imported is the first tab. The name on the tab does not matter.

- The import file must contain the specified columns in the specified order. Each column represents a field on the 8949 screen as determined by the column location (not the header labels, which are optional):

- For acceptable date formats, see "Avoid Common Import Problems" below.

To import the information, complete the following steps:

- From within the client’s tax return, click the Import button on the toolbar and select Form 8949 Import / GruntWorx Trades from the drop menu. The Form 8949 Import / GruntWorx Trades dialog box opens.

- Review the example spreadsheet format. Click Next to open the Form 8949 Import / GruntWorx Trades - Step 1 dialog box.

- Click the Browse button to locate the file containing the transactions. After locating the file, click Open. The transactions are displayed in the Form 8949 Import / GruntWorx Trades - Step 2 dialog box.

- From the Start import at drop list, choose a line to start the import. If the first row in the transaction list is column headers, begin import at row 2. For example, for a GruntWorx Trades, which have a header row, select 2 from the Start import at drop list.

- Click Next to proceed to the Form 8949 Import / GruntWorx Trades - Step 3 dialog box, which displays the information that will be imported. Confirm the data.

- Click Import to import the transactions. A list of 8949 screen opens. Each imported transaction is listed on a separate 8949 screen. Open the first transaction screen, confirm the entries, and press Page Down to review each screen.

- You can prepare a temporary spreadsheet and import it into a test return to see how the process works.

Avoid common import problems:

Microsoft Excel 2003 or later is required for import.

- Must be the full program downloaded from Microsoft, not the Microsoft store (app store). Check to ensure that the full program is installed under your computer's control panel > Add/remove programs.

Except for column headers, don't put anything in the import file that should not be imported.

- If you include column headers, make sure to start importing on the first data row, not the header row.

- If totals are present, remove them. The totals may be imported, doubling your data.

When importing 8949 data from the Drake Tax template, be aware that, depending on the package, data in certain columns is not imported into screen 8949. For instance, in 1120 returns, there is no field on screen 8949 corresponding to the “City” column of the 8949 Import worksheet. When 8949 data is imported, any data entered in this column is ignored. The "TSJ" column on the worksheet also functions differently for business returns, representing alternate fields.

| 1120 |

City, AMT Cost Basis, US Real Property, Adj 1 AMT Amount, Adj 2 AMT Amount, Adj 3 AMT Amount, QSBS Code, QSBS Amount, LLC Number |

Foreign expropriation

|

| 1120-S |

City, AMT Cost Basis, US Real Property, Adj 1 AMT Amount, Adj 2 AMT Amount, Adj 3 AMT Amount, QSBS Code, QSBS Amount, LLC Number |

Property Type

|

| 1065 |

City, AMT Cost Basis, US Real Property, Adj 1 AMT Amount, Adj 2 AMT Amount, Adj 3 AMT Amount, QSBS Code, QSBS Amount, LLC Number |

Property Type

|

| 1041 |

City, US Real Property, LLC Number |

Grantor |

If creating or importing your own worksheet, note that the import file must contain the specified columns in the specified order. Refer to the applicable Drake Tax 8949 Import sheet for the proper order. Each column represents a field on the 8949 screen in the 1040 package (with the exception of the EIN and Use worksheet for accrued market adjustment fields); the column order is determined by the tab order of the fields on the 1040 8949 screen (not by the header labels, which are optional). For example, in the 1120 package, column “D” must always be a placeholder for the 1040 City field, even though there is no such field on screen 8949 for 1120 returns.

Date formats in the Date Sold and Date Acquired columns –

- CSV files or tab-delimited files. These are text files. Dates must be in one of these formats:

- MMDDYYYY (recommended)

- MM-DD-YYYY

- MM/DD/YYYY

- M/D/YYYY

- M-D-YYYY

If you open and save a text file in Excel, take care that default formatting changes don't result in the loss of leading zeros. Note that you can also open, edit and save text files in Microsoft Notepad.

- Excel. The best way to enter dates in Excel is to format the date columns as text in MMDDYYYY format (separators can be used or omitted). If you use other Excel formats:

- Dates in columns formatted in Excel as dates will also import correctly.

- Dates in cells using the default Excel general format may cause difficulties if Excel does not recognize the value as a date. Enter dates using slash separators so Excel will recognize the value as a date. Import errors occur if a date value like "02022011" becomes "2022011" when Excel treats it as a number rather than a date and drops a leading zero. This can also happen when you open a file supplied to you as a CSV or tab-delimited file, save it in Excel and import the saved Excel file.

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!