Can I do a "short year" return in Drake Tax?

Individual Returns (1040):

You cannot generate a short-year individual return in Drake Tax. Only a calendar-year individual return can be generated. There is no option to change this.

Business Returns (1120, 1120-S, 1065, 1041):

Drake Software produces short-year business returns that can be e-filed in the current year and two preceding years. A short-year business return older than two preceding years can be produced in prior versions of Drake Tax, but it must be paper-filed.

Note: The return must reflect the laws and calculations applicable to the short-year period even though the software being used is the prior-year software. The program may not correctly calculate depreciation, gains, or losses for a short-year return. Depreciation for a short-year should be entered on screen 4562 and/or screens 6, 7, and 8; see note 321 for details.

To generate a short-year return:

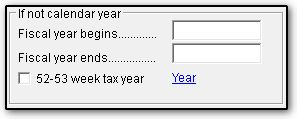

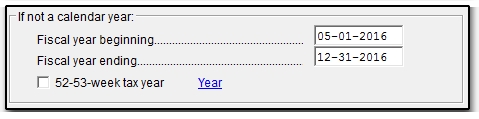

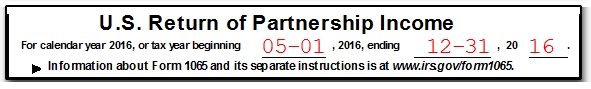

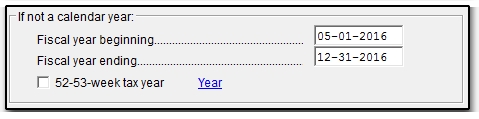

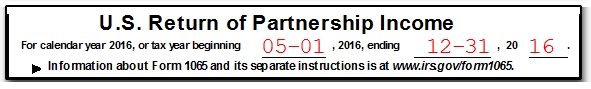

- Enter the appropriate dates in the fiscal year fields on screen 1.

- If this is an initial or final return, also check the box Initial Return or Final Return on screen 1.

- If this is not an initial or final return, you will need to make an short year election on the YEAR screen.

- Note: 1041 returns do not support short-year elections or filing other than in the initial or final year.

- If appropriate selections are not made, EF messages will generate:

- 0081 or 0084 for an 1120

- 0720 or 0727 for an 1120-S

- 0101 for a 1041

- 1023 for a 1065

Short Year Elections

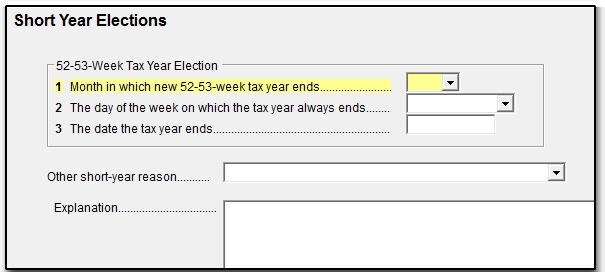

In 1120, 1120-S, and 1065 returns, use the YEAR screen to elect a 52-53 week year or to select that it is a short-year for another reason.

See Publication 4163, for more information. Also See "Period Covered" in the form instructions for short-year returns:

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!