How do I update or replace a PDF file that I previously attached to a return?

Federal Return

For an attachment to a Federal return:

- Go to View.

- Click the Attach PDF button to open the EF PDF Attachments dialog box.

- Select the attachment and click Delete. This returns the selected document to an unattached status and displays an "X" next to it.

- Calculate the return.

- Return to the EF PDF Attachments dialog box.

- Select the attachment

- Click Browse and navigate to the updated document for attachment.

- When you return to the EF PDF Attachments dialog box, confirm that a checkmark is displayed next to the attachment.

- Select the attachment and click View to open it and confirm that it is the updated document.

- Recalculate the return to clear the EF Message.

State Return:

State return attachments that are software attachments (required as a result of data entry in the return) are either:

- Automatic, where the attachment was generated by the software and attached when you clicked the Attach PDF button in View.

- Manual, where you printed the attachment and manually attached it on the EF PDF Attachments dialog box after clicking the Attach PDF button in View.

Automatic

- Calculate the return.

- Go to View.

- Click the Attach PDF button.

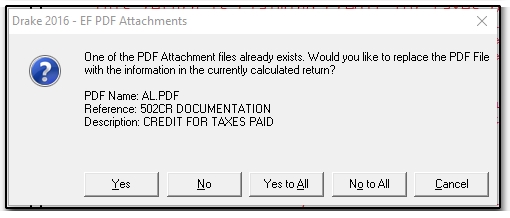

- You are prompted to update an attachment.

- Select Yes to update it (No cycles you through all automatic attachments if there is more than one).

Manual

- Calculate the return.

- Go to View.

- Select the attachment you want to update from the list.

- Click Delete to remove it.

- The attachment now displays an "X" indicating the attachment has not been completed.

- Re-calculate the return.

- Print the updated document to PDF that you want to attach and follow the normal process to attach it.

- After updating a state attachment, click View on the EF PDF Attachments dialog box to open the attachment and confirm that it is the updated document.

- Recalculate to clear the EF Message.

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!