Can I send a federal balance due or ES payment electronically through the PMT screen in a prior year return?

Federal Balance Due:

You can pay a prior year balance due electronically through the PMT screen within the prior year program. The payment would need to be setup and transmitted along with the original filing of the tax return.

Estimated Tax Payments:

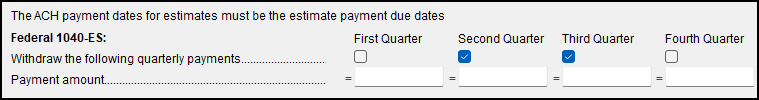

Direct debit of ES payments cannot be made in prior year software. Estimated Tax Payments have to be made before the due date of the selected voucher(s). If you send the return after the due date of the ES Voucher you can unselect the past due voucher(s) checkbox on the PMT screen.

Note: Reject 'FPYMT-086' may result from an ES voucher being transmitted after the printed due date of the selected voucher(s).

For information on setting up an electronic payment within Drake see Related Links below.

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!