How do I enter the sale of a depreciable asset?

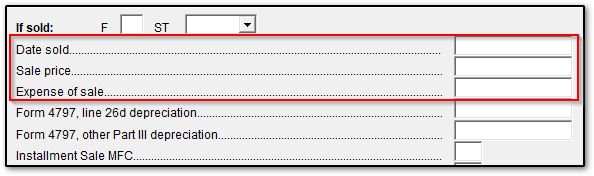

To show that an asset has been sold or disposed of, go to the Income tab > 4562 Depreciation Detail screen for the particular asset and complete the If Sold section:

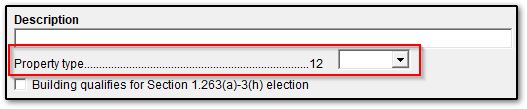

Also ensure that the applicable property type has been selected (at the top left):

Form 4797 will generate based on the Cost/Basis of the asset, prior calculated depreciation and the entries in the following fields:

- Date Sold

- Property Type

- Sales Price (even if zero)

- Expense of Sale

Note: If the asset(s) will be sold as a Group Sale or Installment Sale, see Related Links below.

If an asset is fully depreciated or amortized, the software will continue to update the asset to the next year for record-keeping purposes. If the asset was sold, complete the entries above. If the asset was not sold, but you need to prevent it from carrying forward, use the checkbox Do Not Update to next year. This checkbox prevents the asset from updating to the next year, without showing it as being sold.

If you only enter a date of sale, without a sales price, Return Note 594 will be generated.

For more information, see the Form 4562 instructions and Related Links below.

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!