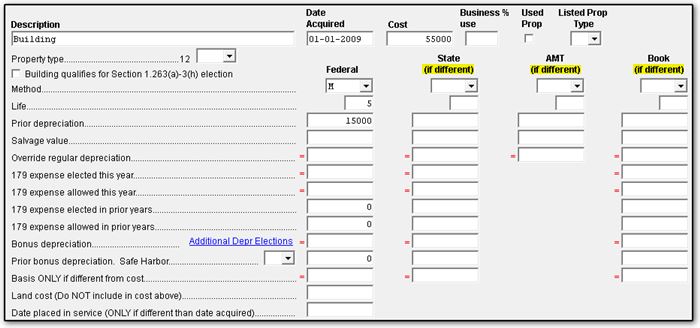

I updated a prior year return to the current year software and some of my depreciation amounts did not update. Why?

Amounts for the State, AMT, and Book depreciation columns will only be updated from the prior year if the amounts differ from the Federal column. As the column header indicates, entries in those columns should only be made when the amounts are different than federal amounts.

If the State, AMT, or Book columns are different than the Federal column, the amounts will be updated to the next year as expected.

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!