I am receiving red message 0042 about the unappropriated retained earnings being out of balance. How can this be corrected?

The first part of message 0042 states:

ANALYSIS OF UNAPPROPRIATED RETAINED EARNINGS OUT OF BALANCE: The Schedule M-2 is out of balance. The amount on Schedule M-2, line 8, does not match the amount on the Schedule L, line 25, column D.

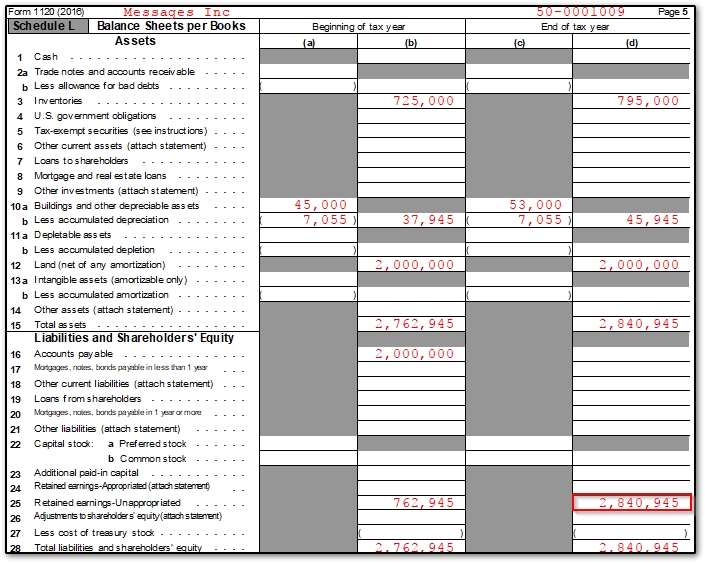

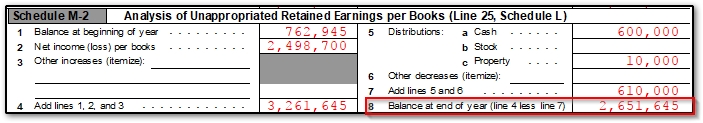

This message occurs when the Schedule L, line 25, column d, does not match the M-2, line 8. Line 25 of the Schedule L reports the amount of unappropriated retained earnings, and Schedule M-2 is the “Analysis of Unappropriated Retained Earnings,” which is calculated based on the information made available by the company’s books. Since both lines report the total unappropriated retained earnings, the amounts must match.

The message goes on to provide suggestions for what could be causing the issue, depending upon the situation:

If the return is in its final year:

If this message is being generated on a final-year return, review entries on the L screen for the end of the year. All assets, liabilities, and capital would have been disposed of and the corporation is deemed to no longer exist for Form 1120 or Form 1120-C purposes. See the instructions for Form 1120, Item E, Final Return, or for Form 1120-C, Item D, Final Return for more information.

If this is a final year return, see the Instructions for Form 1120 for more information on how the IRS expects a Schedule L to be completed. In general, the end of year amounts would be $0, since the company is technically considered to be ended by the end of the filing year.

If the amount on Schedule M-2, line 8 is correct, and line 25 of the Schedule L is incorrect:

- Turn off the auto-balance feature:

- Beginning in Drake20, there is a global setup option to turn off auto-balance. If you want to turn off auto-balance globally for all returns, go to Setup > Options > Calculation & View/Print tab > Turn off auto-balance of the balance sheet. If this is not checked, turn off the auto-balance on a single return by going to the PRNT screen and checking the box Reverse autobalance setup option.

- In Drake19 and prior, go to the PRNT screen and check the box Turn off autobalance.

- When the auto-balance feature is turned on, and the assets section and liabilities and capital section on the Schedule L are not equal, the feature automatically adjusts the unappropriated retained earnings (line 25 of the Schedule L) by the difference between the two sections in order to make the sections equal, or balanced.

- After turning off the auto-balance feature, return to View and see if line 25, column d, now matches line 8 of the M-2.

- If the amount on Schedule M-2, line 8 is correct, and the auto-balance feature has already been turned off, review the amounts on Schedule L. You may need to review the company’s books, the end of year information on the prior year’s return, and the calculations on the current year’s return in order to determine if an amount is missing or appears to be incorrect on the Schedule L. EF message 0042 provides specific suggestions for things to look for:

The out-of-balance problem can originate from any of the following:

-The beginning balance sheet amounts do not tie to the prior-year ending balance sheet amounts

-The beginning-of-year unappropriated retained earnings amount is entered in the appropriated retained earnings field

-The ending balance sheet entries are inaccurate

-The net income per the tax return is inaccurate

If the amount on line 25 of the Schedule L is correct, and line 8 of the M-2 is incorrect, review the M-2:

- Line 1 of the M-2 comes from Schedule L, line 25, column b: the beginning of year unappropriated retained earnings. If line 25, column b, is incorrect, review the Schedule L - you may need to review the company’s books to determine if an amount is missing or was entered incorrectly (see step 3 of the previous section for suggestions).

- The rest of the EF message suggests which areas of the M-1 or M-2 may need to be reviewed:

-The reconciling items on Schedule M-1 need to be adjusted

-The reconciling items on Schedule M-2 need to be adjusted

If the items are off by a couple of dollars or fewer, a rounding may be necessary on the M2 screen. If rounding is not the problem, it will probably be necessary to do a detailed comparison between the corporation's financial records and the completed return information.

- Line 2 of the M-2 flows from line 1 of the Schedule M-1. If line 1 of the M-1 is incorrect, first see the Related Link: 1120 – Calculating Book Income, Schedule M-1 and M-3 for more information on how line 1 of the M-1 was calculated, and options for correcting it. This article may help you determine which reconciliation items on the M-1 need to be adjusted.

- If lines 3, 5a, 5b, 5c, or 6 on the M-2 are incorrect, return to Data Entry and open screen M2. These reconciliation items are direct entry fields, so you can manually correct the amounts on these lines in Data Entry.

- Rounding could be responsible for the mismatch. In these cases, you can use the fields on screens M1 and/or M2, as applicable to account for rounding.

For more information on preparing a schedule L, M-1, or M-2, see the Instructions for Form 1120.

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!